As per the recent study, the Federal Reserve is on track to reduce interest rates as soon as the middle of 2023, and as a consequence, the Euro will strengthen “substantially” versus the Dollar. As a consequence, TS Lombard, a third party economics research firm and consultant, has altered its stance and is now considered a “Dollar bear.”

As per the recent study, the Federal Reserve is on track to reduce interest rates as soon as the middle of 2023, and as a consequence, the Euro will strengthen “substantially” versus the Dollar. As a consequence, TS Lombard, a third party economics research firm and consultant, has altered its stance and is now considered a “Dollar bear.”

“We are pessimistic about the USD. We demoted the dollar to neutral at the start of December because it was struggling to react to bullish forces. Ever since we have increased our dollar skepticism “Skylar Montgomery Koning, senior macro strategist at TS Lombard, states the following.

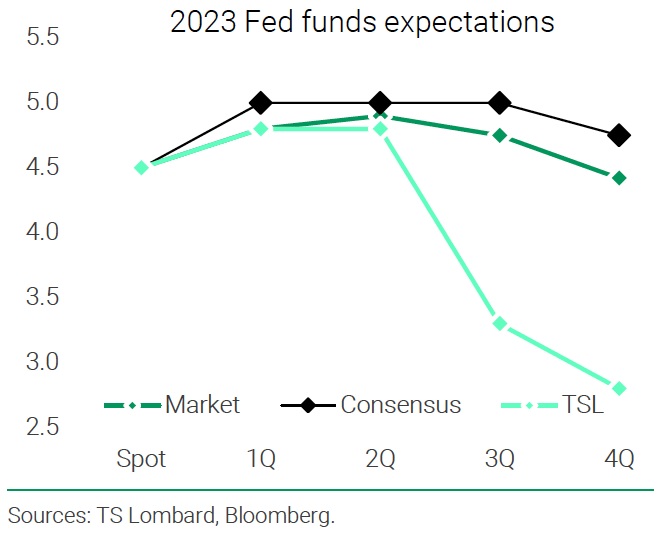

The markets anticipate that the Federal Reserve will hike interest rates by an additional 25 basis points in February, but TS Lombard predicts that this will be the final increase based on apparent indications of inflation decelerating substantially, and that the first decrease would occur in the middle of the year. Last month, U.S. retail sales fell by 1.1% in both aggregate and core measures, which was significantly more significant than the -0.8% decline that the markets had anticipated. This is the newest indication that the U.S. economy is weakening severely.

The Dollar fell in response to the data, and the Euro to Dollar exchange rate (EUR/USD) surged to a multi-month peak of 1.0887 before rebounding to the low 1.08s.

ING Bank’s Chief International Economist, James Knightley, believes the Fed’s rate rises are nearing their conclusion. “We have more signs of weakening activity and a progressively moderate inflation environment,” he says.

ING anticipates two additional 25bp raises over the course of the cycle, however “with recessionary factors deepening and inflationary pressure seeming less and less dangerous, the likelihood of Fed rate reduction later this year is rising,” adds Smith. According to TS Lombard, the market will price in a downturn and accompanying cutbacks, causing rates to decline and the yield curve to slacken.

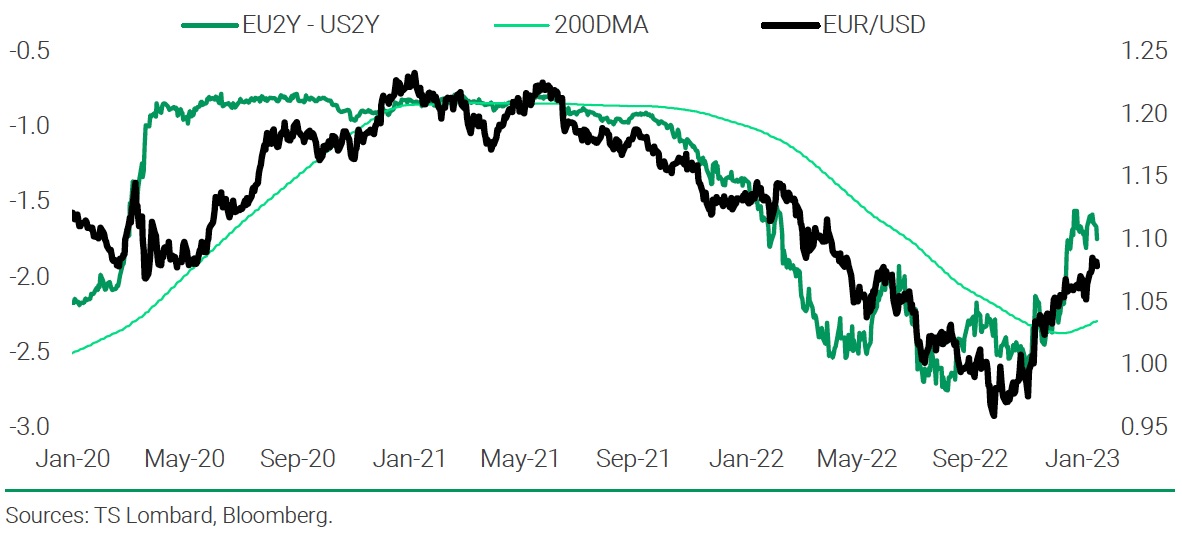

US bond rates are projected to lag in comparison to those of other countries, exerting downward pressure on the Dollar compared to a number of other currencies. According to Koning, rate differentials have moved against the greenback.

“For foreign exchange, yield differential momentum is crucial; we calculate momentum by comparing relative rate differentials to their 200-day moving average. All rate differentials (Europe minus US) throughout the curve have acquired upward momentum, passing their 200-day moving averages and signaling a strengthening of the EUR/USD. In addition, the 2y divergence, which indicated the dollar’s bullish flip in June 2021, has shifted in support of euro appreciation for the initial time ever since “says Koning.

The narrative for markets in 2023, according to TS Lombard, will switch from whether the US Federal Reserve would cut to how far, and traders are not yet prepared, since the current price of cuts for 2023 is just 60bp. Consequently, this narrative contains more to attract Dollar bears.

In the meantime, it is anticipated that the European Central Bank (ECB) would retain a more “hawkish” attitude, supporting the Euro. “The ECB has a tendency toward overtightening, although it started its tightening cycle later than the remainder of the DM, resulting in a lower cumulative degree of tightening. This implies that European interest rates are less constraining, providing the ECB greater space to raise rates and then halt at this point of the business cycle “says Koning.

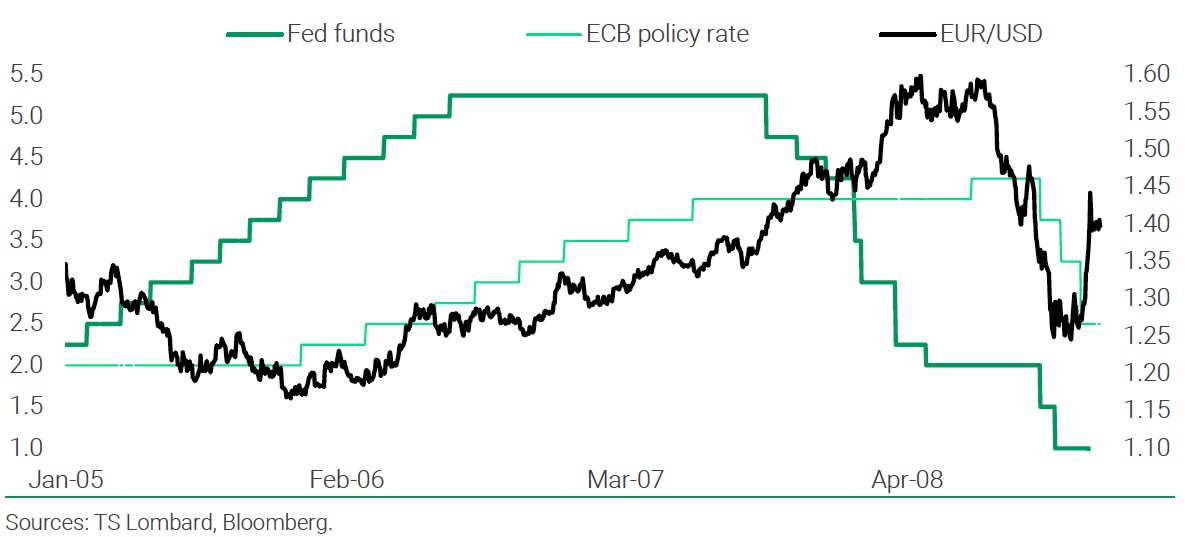

The ECB is anticipated to increase interest rates by 50 basis points in both February and March, and maybe even more if the most recent comments from Governing Council members are accurate. According to TS Lombard, the era of 2006-2007 provides a recent example of near-term Fed-ECB deviation: At that moment, the ECB had begun its raising cycle later than the Fed and, as a result, still had the capacity to increase rates while the Fed halted.

In the second part of 2007, speculation surrounding Fed rate reduction grew until the Fed was obliged to reduce rates. “The ECB jumped on the bandwagon around a year afterward, although the EUR/USD strengthened substantially throughout this two-year period,” explains Koning.