Euro exchange rates gained ground ahead of the weekend, driven by inflation data from the Eurozone that exceeded expectations for April. The report suggested that the likelihood of a series of interest rate cuts by the European Central Bank (ECB) might be diminished.

Euro exchange rates gained ground ahead of the weekend, driven by inflation data from the Eurozone that exceeded expectations for April. The report suggested that the likelihood of a series of interest rate cuts by the European Central Bank (ECB) might be diminished.

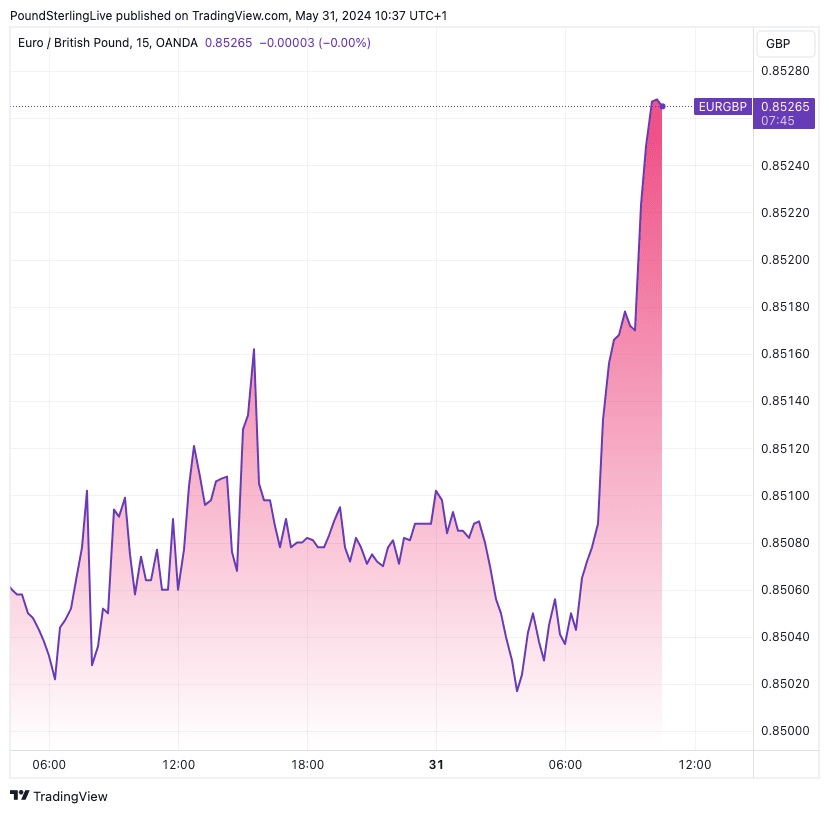

The Euro to Pound exchange rate saw a rise of 0.25%, reaching 0.8527. This movement followed the release of data from Eurostat indicating that the Harmonized Index of Consumer Prices (HICP) in the Eurozone increased to 2.6% year-on-year, up from 2.4%, and surpassing expectations of 2.5%. Additionally, core HICP, which excludes volatile items like food and energy, climbed to 2.9% from 2.7%, again exceeding the anticipated 2.8%. This data presents a potential challenge for the ECB, coming just days before an anticipated interest rate cut.

The Euro to Dollar exchange rate also extended its recovery over two days, reaching 1.0840. Although the ECB is widely expected to implement an interest rate cut at its upcoming meeting on Thursday, the timing of any further rate reductions remains uncertain. Prior to the inflation data release, there had been speculation about a consecutive rate cut in July, a scenario that might have put downward pressure on the Euro. However, the stronger-than-expected inflation figures have reduced the likelihood of such a development, as reflected in the Euro’s rise.

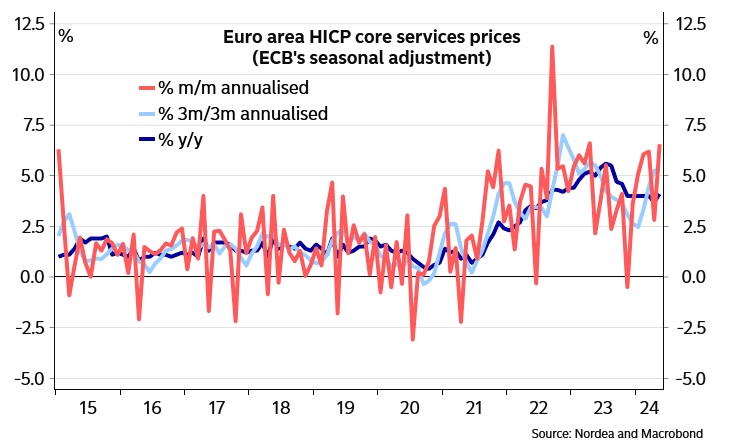

Market analysts have suggested that the ECB is likely concerned by the inflation data, which underscores the risks of rising services prices. TD Securities commented that policymakers may have set a high threshold for delaying the anticipated rate cut next week, but the elevated services inflation strengthens the case against a second cut in July. This follows last week’s strong wage growth figures, which, despite being downplayed by the ECB, indicate a potentially turbulent path to achieving the target inflation rate of 2%.

Anders Svendsen, Chief Analyst at Nordea bank, noted that the rise in core services inflation heightens concerns about the tight labor market, which could hinder the gradual decline of inflation in line with the ECB’s projections. He pointed out that recent negotiated wage data for the first quarter also exceeded expectations, suggesting that wage growth might slow less than the ECB anticipates, thereby prolonging high core services inflation.

The inflation data and expectations for the ECB’s response to rate cut speculations at next week’s meeting may position the Euro for a strong start in June. Bert Colijn, Senior Economist for the Eurozone at ING Bank, mentioned that the key issue remains the number of subsequent rate cuts. The May inflation figures serve as a caution that next week’s rate cut might not initiate a typical cutting cycle. Colijn highlighted that with unemployment at a record low of 6.4%, the trajectory of wage growth throughout the year remains uncertain. He added that while the outlook for wages is sufficiently positive to justify a rate cut next week, it is the first such cut since 2019.

In conclusion, the unexpected inflation data from the Eurozone has impacted the exchange rates and influenced market expectations regarding the ECB’s monetary policy. The Euro’s rally against both the Pound and the Dollar reflects the market’s reassessment of the likelihood of further rate cuts following the ECB’s anticipated action next week. The data suggests a complex economic landscape ahead, with the ECB navigating between inflation control and economic growth.