In a recent market analysis, strategists at CIBC Bank have advised selling the Canadian Dollar (CAD), citing unfavorable market positioning and the likelihood of disappointing economic data in Canada. The recommendation to sell the CAD is also rooted in the observation that the ongoing surge in oil prices, traditionally seen as beneficial for a commodity currency like the CAD, is not providing the anticipated support due to shifting dynamics in Canada’s oil exports.

In a recent market analysis, strategists at CIBC Bank have advised selling the Canadian Dollar (CAD), citing unfavorable market positioning and the likelihood of disappointing economic data in Canada. The recommendation to sell the CAD is also rooted in the observation that the ongoing surge in oil prices, traditionally seen as beneficial for a commodity currency like the CAD, is not providing the anticipated support due to shifting dynamics in Canada’s oil exports.

Bipan Rai, Head of FX Strategy at CIBC Capital Markets, noted that the economic outlook in Canada appears weaker, as the Bank of Canada (BoC) recently acknowledged the expectation of weaker growth, primarily due to a “marked weakening in consumption growth for Q2.”

Economic Data and Changing Oil Dynamics Weigh on the CAD

CIBC highlights the CAD’s vulnerability against the U.S. Dollar (USD) due to the sustained strength of the U.S. economy. Analysts argue that the market’s anticipation of more interest rate cuts by the Federal Reserve in 2024 compared to the Bank of Canada is a miscalculation, given the stronger economic data in the U.S.

Rai explains that “Stronger U.S. data, alongside downside risks to incoming CAD data, suggests that forward OIS should shift to more realistic levels. That suggests USD/CAD upside at the margin.”

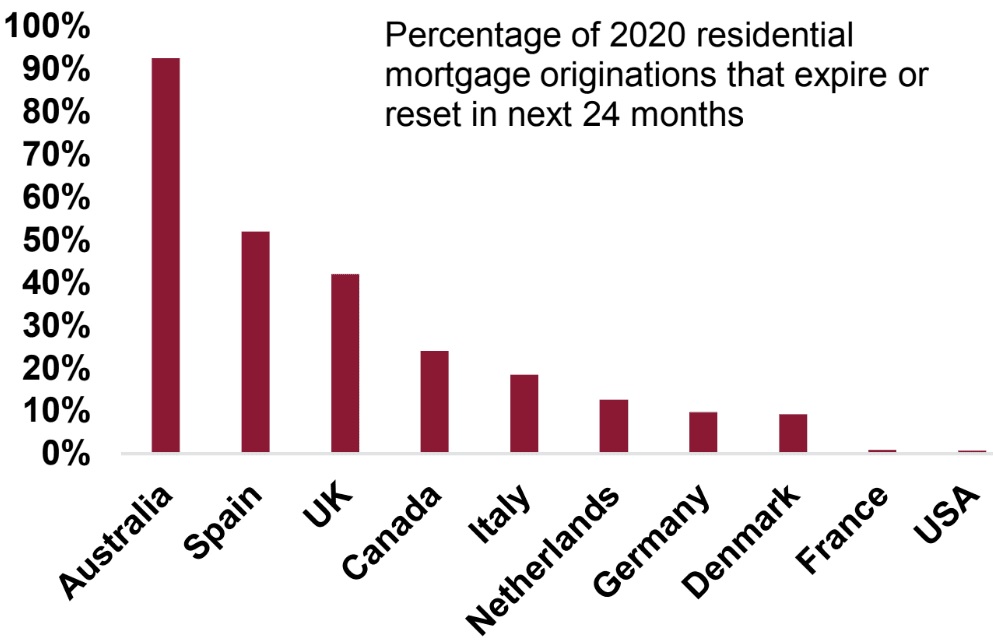

CIBC’s analysis also points to easing excess demand conditions in Canada, which are progressing more rapidly than the Bank of Canada had expected earlier in the summer. This situation implies that inflation in Canada could decrease at a faster rate. Factors contributing to this scenario include higher debt servicing costs resulting from previous interest rate hikes and a larger proportion of household income being saved in preparation for mortgage reset risks in the coming years. Consequently, the CAD appears more susceptible to slower domestic economic activity as the impact of monetary tightening filters through to real economic activity.

Regarding the relationship between oil prices and the CAD, Rai notes that “higher oil prices aren’t likely to be a driver of CAD strength” as it had been previously assumed. While higher oil prices were traditionally seen as translating into increased revenues for the Canadian private sector and, subsequently, higher aggregate demand, this relationship has evolved. The complicating factor is that the United States has emerged as the world’s largest producer of crude oil and petroleum products, leading to consistent U.S. imports of CAD crude over the past few years.

CIBC also highlights a notable net position skew in the CAD, with asset managers and non-commercials increasingly holding net short CAD positions in recent weeks. This suggests the potential for long CAD positions to unwind in favor of USD/CAD upside.

CIBC’s strategists have set a target for USD/CAD to reach 1.3950, with the current exchange rate standing at 1.3530 at the time of this analysis.