The Pound faced challenges below a crucial technical support level against the Dollar and encountered difficulties against the Euro on Friday. This development followed a weakening global market risk appetite, triggered by an earlier rally in government bond yields that contributed to losses in the Sterling.

The Pound faced challenges below a crucial technical support level against the Dollar and encountered difficulties against the Euro on Friday. This development followed a weakening global market risk appetite, triggered by an earlier rally in government bond yields that contributed to losses in the Sterling.

During Thursday’s trading, Sterling slipped below the 1.26 mark against the Dollar for the first time since June. These losses persisted through Asian and European trading on Friday as market participants eagerly awaited forthcoming remarks from Federal Reserve (Fed) policymakers.

Alvin Tan, Head of Asia FX Strategy at RBC Capital Markets, explained that the US dollar gained strength due to higher US interest rates, pushing the DXY Index above 104. He also mentioned reports indicating that the People’s Bank of China (PBOC) had requested local banks to curtail their outward bond investments via the Bond Connect channel, underscoring efforts to safeguard the renminbi.

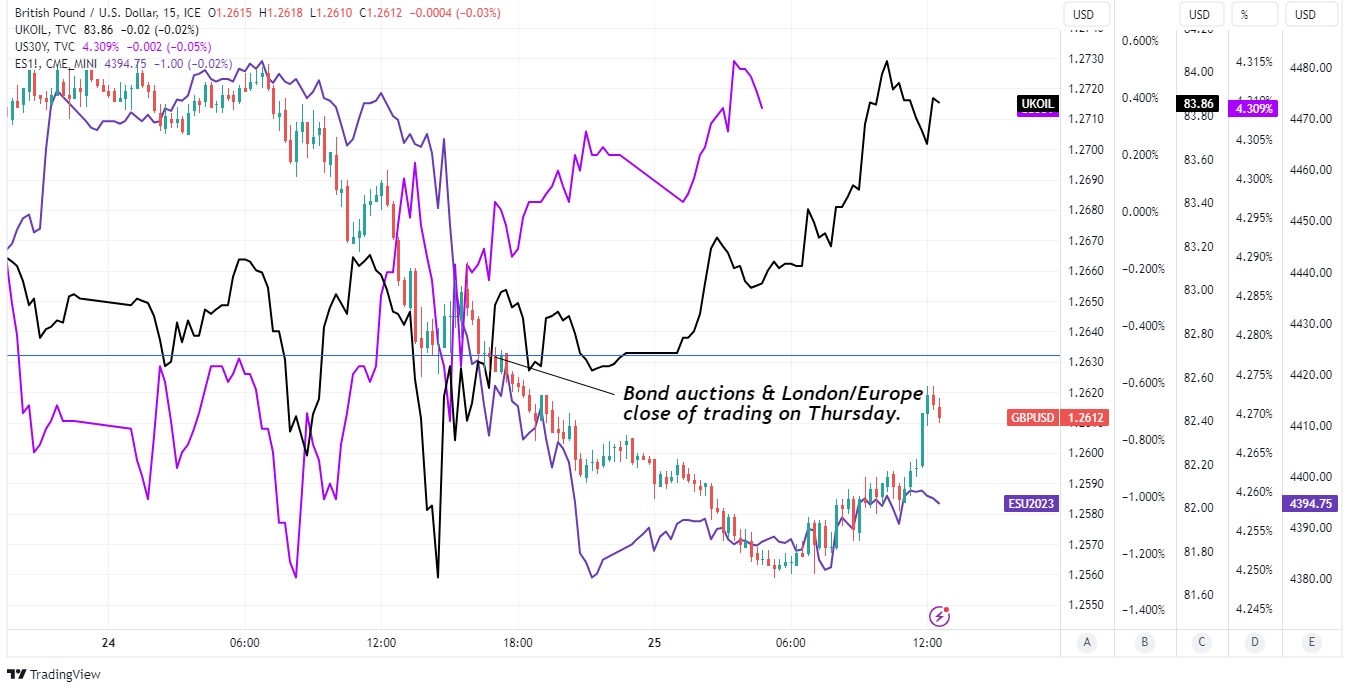

The Pound had maintained robust support levels between 1.26 and around 1.2632 since early June. However, this threshold was breached between London and New York trading closures on Thursday. The Pound to Dollar losses deepened as US Treasury bill auctions and a larger sale of 30-year inflation-linked bonds took place during the latter part of the European trading session.

The situation was exacerbated by the infusion of new and anticipated supply into the market, as the Treasury sought to replenish cash reserves that had been depleted during the lead-up to and execution of raising the statutory US government debt limit in April.

Praveen Korapaty, Chief Interest Rate Strategist at Goldman Sachs, noted a noticeable rise in bond risk premia during the month, contributing to a bear steepening in US yields. Goldman Sachs analysts had previously estimated the influence of supply on yields, suggesting a moderate and gradual impact on yields, although they acknowledged concerns from investors. The stock of debt, according to their analysis, could lead to an increase of around 40-80 basis points in 10-year yields over time.

Demand for US bonds increased compared to previous auctions, but this came at the cost of higher yields. Mixed messages from Fed officials regarding the interest rate outlook further added to the uncertainty.

Ian Shepherdson, Chief Economist at Pantheon Macroeconomics, highlighted the FOMC’s stance, indicating that further rate hikes “may” be necessary, with decisions being data-dependent and reviewed on a meeting-by-meeting basis. Sterling had previously faced pressure when the Confederation of British Industry (CBI) cautioned that sales and employment levels were likely to decline among large UK retailers in August.

Recent setbacks compounded losses observed earlier in the week. S&P Global PMI surveys on Wednesday signaled potential recessionary conditions in the manufacturing and services sectors, impacted by increased costs and lower consumer demand in some segments.

Andrew Goodwin, Chief UK Economist at Oxford Economics, acknowledged the concerns raised by the sharp fall in the composite PMI, suggesting a loss of momentum in the UK economy. While such surveys can exaggerate economic cycles, the forthcoming availability of this year’s decline in wholesale energy prices through the government price cap scheme could offer some relief to consumers from October onward.