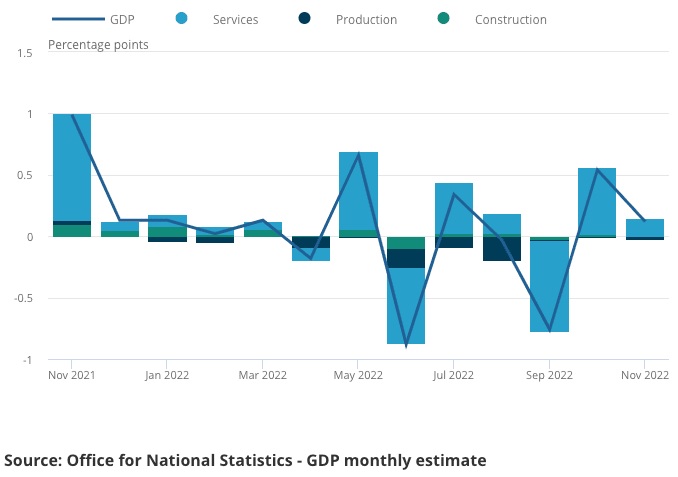

The British Pound climbed against the Euro and the US Dollar on Friday, as markets analyzed the first big UK data publication of 2023, which revealed that the UK economy surprisingly expanded in November. The ONS reported that the economy gained 0.1% in November due to a 0.2% growth in the services industry, making it unlikely that the United Kingdom would enter a downturn in the fourth quarter of 2022.

The British Pound climbed against the Euro and the US Dollar on Friday, as markets analyzed the first big UK data publication of 2023, which revealed that the UK economy surprisingly expanded in November. The ONS reported that the economy gained 0.1% in November due to a 0.2% growth in the services industry, making it unlikely that the United Kingdom would enter a downturn in the fourth quarter of 2022.

The better-than-expected number contradicted the market’s average forecast of a 0.3% decline. “In November, the UK’s monthly GDP increased 0.1% MoM as the economy keeps showing resilience in the face of rising inflation. Interestingly, NHS Test and Trace and COVID-19 vaccination program activities decreased by 63% in November, reducing monthly GDP by 0.2 percentage points; hence, underpinning growth is stronger “In reaction to the findings, Saltmarsh Economics notes the following.

Notwithstanding a lackluster 0.2% annual growth from November to December, the prevailing pessimism about the UK economy will be countered by official statistics and incoming indications that the economy performed well in December in spite of persistent inflationary pressures. Julian Jessop, Independent Economist and Economics Fellow at the IEA, said, “Recollect the tight conclusion that the UK will face the worst downturn of any large economy.”

In general, currencies seek support when domestic information exceeds expectations; hence, Friday’s GDP report is theoretically favorable for the Pound. “During the past week, retailers have reported stronger-than-expected fourth-quarter earnings, and it seems that stronger-than-anticipated consumer services and facilities, in general, have aided the UK economy to confound pessimistic anticipations,” asserts Jonathan Moyes, head of investment research at Wealth Club. “Several people will be surprised by the revelation made today.”

The Pound to Euro exchange rate rebounded from previous lows to reach 1.1270, despite the fact that the short-term trajectory remains negative due to a rise in attitude toward the Eurozone’s common currency as a result of lowering gas costs.

The Dollar seems to be under pressure as a result of Thursday’s softer-than-anticipated U.S. inflation figures, allowing the Pound to Dollar exchange rate to rise to 1.2240. According to Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, the fourth quarter GDP would increase by 0.1% if December’s level remained constant from November’s.

“In other words, the GDP would have to decline by a minimum 0.4% month-over-month in December for it to decline by 0.1% quarter-over-quarter in the fourth quarter,” he argues.

However, based on the financial outcomes of companies like Tesco, Sainsbury’s, and M&S, this seems doubtful. The ONS also discloses that the UK’s manufacturing and industrial areas stay under strain, a reality that has been mostly omitted from the currency calendar so far this year.

Industrial Production fell 0.2% in November, although this was greater than the -0.3% that the market had anticipated. The manufacturing sector declined by 0.5% in November, contrary to the -0.2% that the market anticipated. Aside from this, the index of services fell 0.1% in November, which was lower than the -0.3% the market had anticipated.

The future for the United Kingdom remains bleak, but the widespread pessimism that has characterized recent conventional thinking is being questioned.

“A silent consensus seems to be building in the United Kingdom, although it could be too early to call it a shift in mood. Energy costs are dropping precipitously, China is recovering, and benchmark interest rate forecasts have softened considerably “states Moyes.