Pound Sterling remained steady as it approached the weekend, buoyed by better-than-expected retail sales data, though analysts caution that the sell-off following the inflation release earlier in the week may not be fully concluded.

Pound Sterling remained steady as it approached the weekend, buoyed by better-than-expected retail sales data, though analysts caution that the sell-off following the inflation release earlier in the week may not be fully concluded.

In June, UK retail sales saw a month-on-month rise of 0.7%, surpassing market expectations of 0.2%. The year-on-year figures were also better than anticipated, with sales at -0.1% compared to the expected -1.5%. All sectors reported increased sales, indicating a positive trend in the economy.

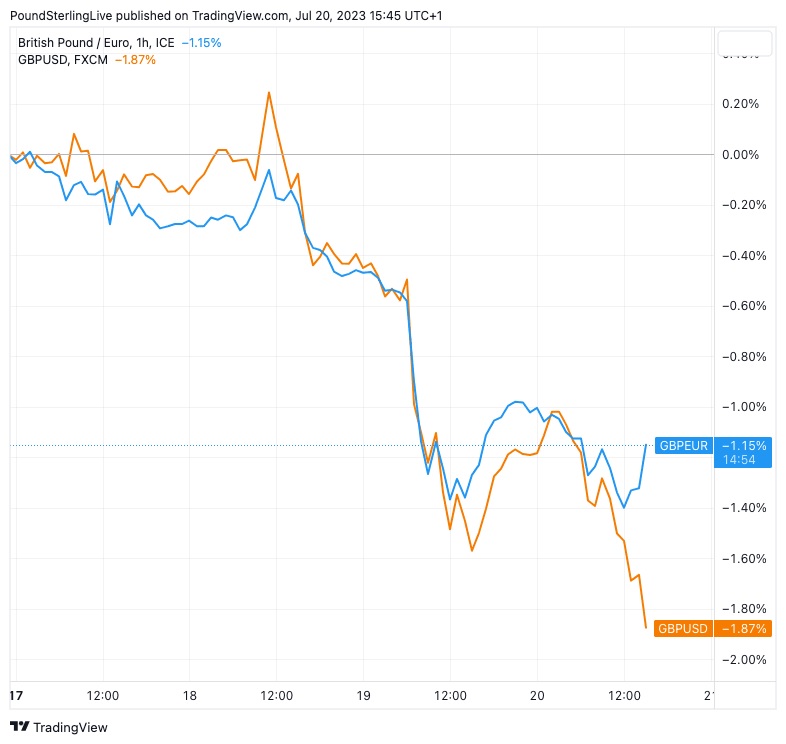

Following the release of the data, the Pound to Euro exchange rate rose 0.20%, reaching 1.1590, narrowing its weekly loss to approximately 0.70%. Meanwhile, the Pound to Dollar exchange rate increased 0.20% to 1.2890, though it still suffered a weekly loss of 1.70%.

Looking ahead, analysts believe that sales volumes are likely to rise in the latter half of the year as real disposable incomes recover. The continuous increase in wages is expected to outpace price rises, contributing to improved economic conditions.

The retail sales data, while not top-tier in importance, provides insights into the underlying state of the economy. As the market closely monitors future UK interest rate decisions based on jobs, wages, and inflation figures, these retail sales figures may offer some guidance.

The Pound’s recent decline can be attributed to a shift in market expectations for a 50 basis point hike at the Bank of England’s August 03 policy decision, which now stands at around 40% odds, down from being considered a sure-fire bet just a week ago.

Analysts expect further weakness in the Pound in the near term, as it deflates from its top-performing position in 2023 heading into August. However, analysts also foresee a more sustained rally against the Euro in 2024, as the Bank of England implements further rate hikes and other central banks ease their policies.

Georgette Boele, Senior FX Strategist at ABN AMRO, predicts the Pound-Euro exchange rate to reach 1.1628 by the end of 2023 and 1.22 by the end of 2024. The Pound-Dollar exchange rate is expected to decline to 1.25 by the end of this year, followed by a rally to 1.28 by the end of 2024.