“Domestic Retail Sales and Global Market Conditions Propel NZD”

“Domestic Retail Sales and Global Market Conditions Propel NZD”

The New Zealand Dollar (NZD) has emerged as the top-performing major currency leading into the weekend, driven by favorable global market conditions, recent initiatives by China to stimulate its domestic economy, and encouraging figures from New Zealand’s retail sector.

“NZ Retail Sales Defy Expectations”

According to David Forester, Senior FX Strategist at Crédit Agricole, an unexpected positive turn in New Zealand’s retail sales has positioned the NZD as the standout G10 currency. Stats NZ reported that retail sales volumes for the third quarter registered at 0% quarter-on-quarter, surpassing market expectations of -0.8% and marking a significant recovery from Q2’s -0.9%. These figures have raised hopes for an optimistic release of GDP numbers on December 14, further bolstering the New Zealand Dollar.

Global Factors Driving NZD Strength

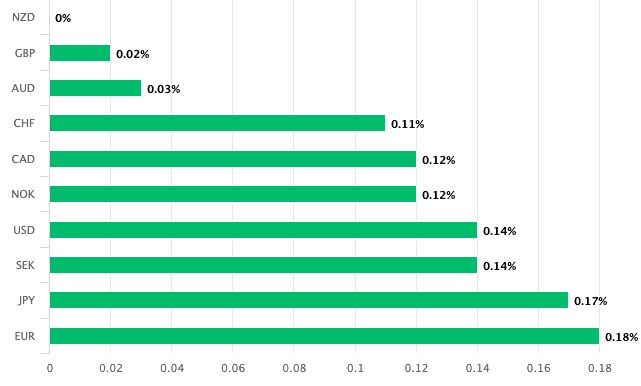

While the robust domestic retail figures contribute to the NZD’s strength, the primary impetus behind its surge lies in favorable global market dynamics. November has shaped up to be the best month of 2023 for world stock markets, influencing positive investor sentiment. Traditionally, improvements in investor confidence have a supportive effect on the New Zealand Dollar, which has demonstrated strength against all major currencies (excluding the Krona) over the past month.

“China’s Economic Boost Amplifies NZD’s Short-Term Gains”

China’s recent efforts to fortify its property sector have provided an additional boost to the NZD. Natixis, the investment and commercial bank, notes that China’s unprecedented support plan, particularly in allowing banks to extend unsecured short-term loans to qualified developers, has contributed to the prevailing market optimism. Francesco Pesole, FX Strategist at ING, emphasizes that China’s significance as New Zealand’s primary export destination underscores the impact of Chinese economic health on New Zealand’s domestic outlook. The NZD, often considered a liquid proxy for exposure to China, is consequently influenced by positive developments in the Chinese economic landscape.

Cautious Optimism: Concerns Surrounding Chinese Assets

While the supportive measures by China are seen as positive on paper, ING’s Pesole urges caution, noting a discernible sense of concern in Beijing regarding the developers’ crisis. The move to allow banks to issue unsecured short-term loans is viewed as a response to the challenges faced by the real estate sector, indicating a cautious approach by Chinese authorities.

“Interconnected Dynamics: NZD as a Liquid Proxy for China Exposure”

The interconnected dynamics between China’s economic decisions and the NZD highlight the currency’s role as a liquid proxy for exposure to the Chinese market. The recent surge in the NZD, influenced by both domestic and global factors, underscores the complexity of factors shaping currency movements in an interconnected global economy.