The GBP/CAD currency pair lost ground Friday, but the underlying bullishness on chart has encouraged Scotabank analysts to study the odds of the pair moving into a higher band in the forthcoming weeks, even though predictions from HSBC indicate that the Canadian dollar should reverse and keep the GBP/CAD exchange rate at a lower level by the year end.

The GBP/CAD currency pair lost ground Friday, but the underlying bullishness on chart has encouraged Scotabank analysts to study the odds of the pair moving into a higher band in the forthcoming weeks, even though predictions from HSBC indicate that the Canadian dollar should reverse and keep the GBP/CAD exchange rate at a lower level by the year end.

Just before the weekend, the pound lost steam following the release of January retail sales data, reflecting the steepest decline since April 2021, from the UK. Notably, IHS Markit PMI (service and manufacturing) data presented a rosy picture.

The 8.2% decline in January was the steepest since the country went for the first complete month of ‘lockdown’ in 2021, even though the data was released only a few hours before solace by means of better-than-anticipated PMI data of services and manufacturing industry.

The crucial services PMI increased to 49.70 in February, from 39.50, surpassing the forecast of 42.10, placing the sector closer to a return to expansion. During the same period, the manufacturing PMI increased and surprised economists who anticipated a decline.

The pound was already the top performer for the week, in spite of getting almost no support from the data. The GBP/CAD had rallied over 1.76 and could reach 1.80 in the forthcoming weeks, as per Scotia bank.

According to Juan Manuel Herrera, a currency strategist at Scotiabank, the level of 1.7675 will be reached eventually. He justified his argument by pointing to oscillators which signal bullishness in all time frames (short, medium and long). Once that level is broken, he expects the currency pair to trade between 1.80-1.85 range.

In recent times, Sterling has gained even against the Canadian dollar, which itself has performed well against its peers against the backdrop of rising crude prices. Investors apparently remained optimistic about the forecast for the global economic activity and also currencies that fluctuate to the continuously changing views, with the UK’s edge in the Covid-19 vaccination race against other countries and fading away of worries related to ‘no-deal’ Brexit frequently being pointed out for the stunning performance of the pound.

Paul Mackel, global head of FX research at HSBC, opined that the pound rallied against the backdrop of increasing risk-on sentiment across the globe and optimism induced by quick pace of vaccinations in the UK.

Sterling’s uptrend has been aided by accumulation of Forex reserves by central banks across the globe. Confidence about the ability of policymakers at the Bank of England to attain the country’s inflation target is also perceived as a reason for the accumulation of the pound.

Analysts at HSBC believe that the improve growth outlook of the UK that has made the BoE confident of achieving its inflation target applies to Canada as well. HSBC believes that Canada will outperform forecasts of economists and also the UK economy in the quarters ahead.

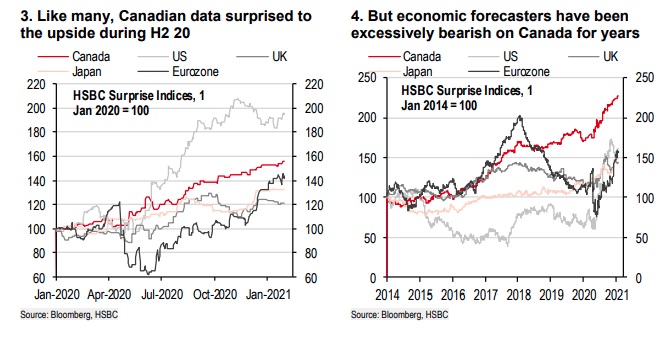

Daragh Maher, head of Americas FX strategy at HSBC, points to the below chart (HSBC economic activity surprise indices) covering Canada, the UK, the US and Japan and the Eurozone since the beginning of 2020, and states that the data took analysts by surprise. Specifically, highlighting the chart, the analyst stated that the ability of Canadian economy has been underestimated by investors and economists for a long-time.

The research team of HSBC also pointed out that the Canadian government’s initiatives to mitigate the crisis caused by Covid-19 were vigorous in comparison to other top economies and it may work well for the revival of economic activity.

As the economy had always been an outperformer of forecasts, analysts believe that the Canadian economy and the Loonie could surprise the market in the second half of this year. Based on above arguments, HSBC predicts the GBP/CAD pair to trade at 1.6350 by the end of this year, a level seen last September. It is also the post-referendum low for the pound.