The New Zealand Dollar (NZD) exhibits resilience in the currency markets, demonstrating strength as traders factor in the likelihood of an additional interest rate hike at the Reserve Bank of New Zealand (RBNZ). According to Carol Kong, a strategist at Commonwealth Bank, “NZD/USD jumped about 0.5% in the Asia session as market participants raised the prospect of another RBNZ rate hike.”

The New Zealand Dollar (NZD) exhibits resilience in the currency markets, demonstrating strength as traders factor in the likelihood of an additional interest rate hike at the Reserve Bank of New Zealand (RBNZ). According to Carol Kong, a strategist at Commonwealth Bank, “NZD/USD jumped about 0.5% in the Asia session as market participants raised the prospect of another RBNZ rate hike.”

Exchange Rates Reflect Market Sentiment

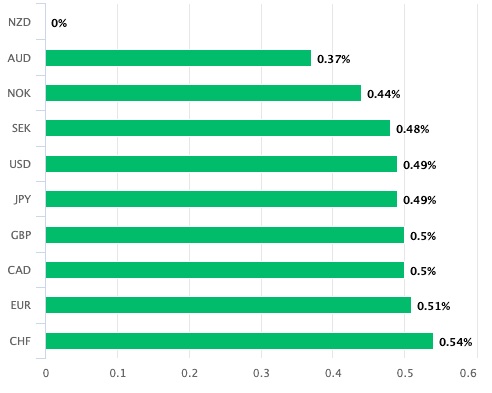

Both the Pound to New Zealand Dollar and the Euro to New Zealand Dollar witness declines of approximately 2.06 and 1.7585, respectively. Market sentiments are notably influenced by the anticipation of a potential rate hike by the RBNZ.

Investors Gauge a High Probability of Rate Hike

Money market pricing reveals that investors currently assign a 90% probability to another 25 basis points interest rate hike by May. Furthermore, market dynamics have led to a shift in expectations, with the initial projection for the first RBNZ rate cut being postponed to November.

RBNZ’s Position in Global Monetary Policy

If the anticipated rate hike materializes, the RBNZ would emerge as one of the last major central banks to implement rate cuts. This strategic positioning is anticipated to provide additional support to the NZ Dollar through the interest rate channel.

Positive Reassessment Triggered by Robust Labor Market Data

Carol Kong notes, “The sharp repricing came after the stronger than expected Q4 2023 NZ labour market data earlier in the week.” New Zealand’s employment, registering a 0.4% quarter-on-quarter increase in the fourth quarter of 2024, surpassed market expectations of 0.3%. This positive shift marks a return to growth following the third quarter’s -0.2% contraction.

Elevated Likelihood of RBNZ Action

Economists at ANZ assert that the prospect of a 25 basis point hike from the RBNZ in the upcoming month has become increasingly tangible. The speech by RBNZ Governor Orr on 16 February is anticipated to further influence the market’s perceived probability of an imminent rate hike.