Euro exchange rates may depend on additional interest rate increases by the European Central Bank (ECB) in response to news that the largest economy in the Eurozone continues to experience widespread inflationary pressures. The Euro was the best-performing major currency on March 30 after Germany’s CPI inflation exceeded expectations, which analysts say will keep the ECB on track to raise interest rates.

Euro exchange rates may depend on additional interest rate increases by the European Central Bank (ECB) in response to news that the largest economy in the Eurozone continues to experience widespread inflationary pressures. The Euro was the best-performing major currency on March 30 after Germany’s CPI inflation exceeded expectations, which analysts say will keep the ECB on track to raise interest rates.

Carsten Brzeski, global head of macro at ING Bank N.V., states, “underlying inflationary pressures remain elevated.” According to Destatis, the headline German CPI rose 7.4% year-over-year in March, exceeding expectations for a reading of 7.1% and declining from February’s 8.7% reading. The month-over-month increase was 0.8%, which was greater than the 0.7% expected by the market. “The fact that the month-to-month change in headline inflation was clearly above historical averages in March is not causing celebration,” Brzeski explains.

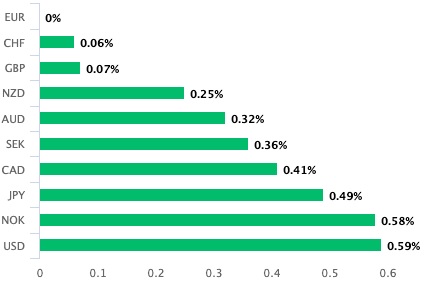

The Euro outperformed all other major currencies on the day Germany released its inflation data, with the Euro/Dollar exchange rate increasing by 0.60 percent to 1.0907 and the Euro/Pound exchange rate increasing by 0.13 percent to 0.8880. Joe Manimbo, Senior FX Analyst at Convera, explains, “The European currency shared by 20 countries is benefiting from two tailwinds: reduced anxiety over banking instability, which is reducing safety flows into the dollar, and expectations that the ECB will hike rates more than the Fed for the remainder of the year.”

According to ING, there are two factions with opposing interpretations of the data and divergent prospective implications for the Euro outlook. One camp will regard the precipitous decline in headline inflation as evidence that the past year’s inflation surge was a long-lasting and transitory energy price shock.

This group may be inclined to believe that the ECB can afford to slow down the rate of its rate raises. ING, however, is in Camp Two: “If you believe this thesis, today’s decline in headline inflation marks the beginning of a lengthier disinflationary trend. As much as we sympathized with this viewpoint one or two years ago, inflation has become a demand-side issue that has permeated the entire economy, according to Brzeski.

ING anticipates the ECB to raise rates by 25 basis points twice more, which would exceed what the market anticipates from the Bank of England, U.S. Federal Reserve, Reserve Bank of Australia, and a number of other developed market banks.

This distinction could therefore provide additional potential for the Euro versus currencies issued by central banks at the end of their cycles. According to Morgan Stanley, the Bank of England is anticipated to leave interest rates unchanged in May, which will deny upward support to UK bond yields. In the meantime, the ECB is expected to raise rates up to three more times, providing EUR/GBP upside support. Morgan Stanley is a buyer of EUR/GBP with a target of 0.93, giving a potential downside target for the Pound to Euro (GBP/EUR) of 1.0752.