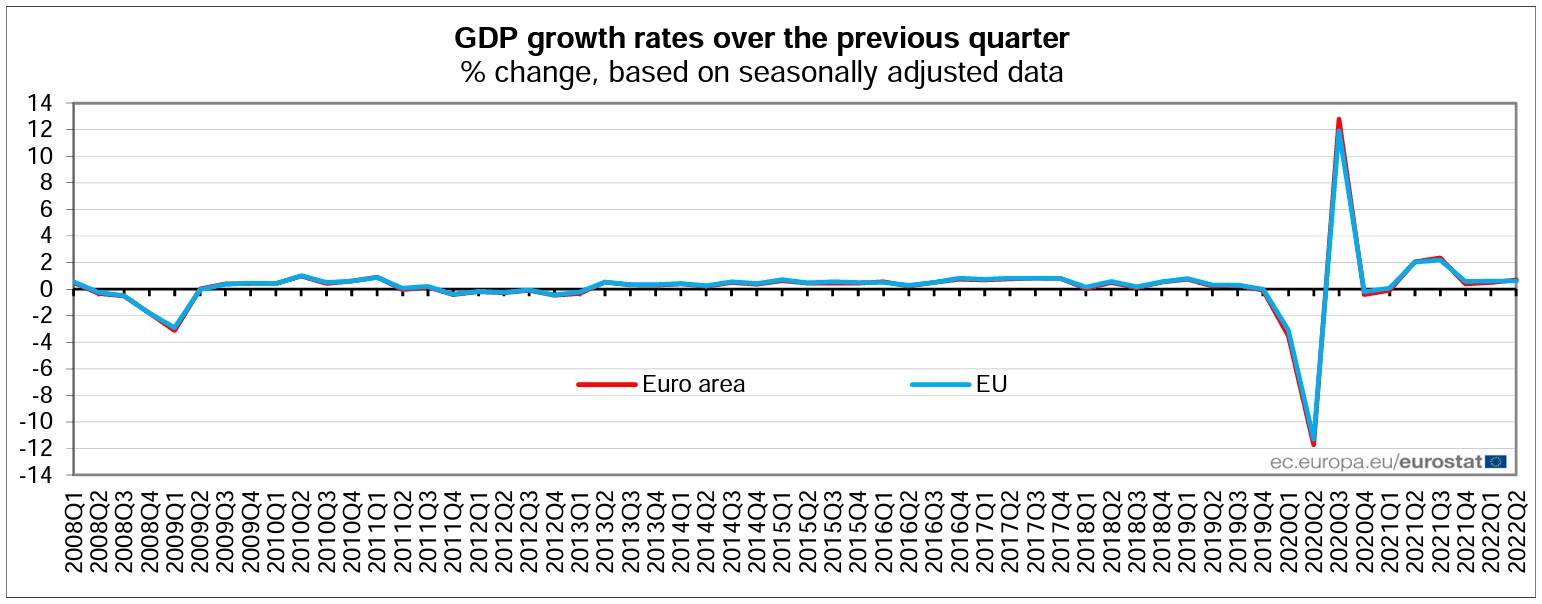

Due to inflation and GDP numbers that were higher than expected by the market on the last trading day of July, the euro appreciated against the dollar. According to figures from Eurostat, the Eurozone’s gross domestic product (GDP) increased by 0.7 percent quarter-over-quarter in the second quarter of 2022, beating expectations for a rise of 0.2 percent and breaking the previous record of 0.6 percent growth.

Due to inflation and GDP numbers that were higher than expected by the market on the last trading day of July, the euro appreciated against the dollar. According to figures from Eurostat, the Eurozone’s gross domestic product (GDP) increased by 0.7 percent quarter-over-quarter in the second quarter of 2022, beating expectations for a rise of 0.2 percent and breaking the previous record of 0.6 percent growth.

GDP increased by 4.0 percent in the year that ended with the second quarter, above forecasts of 3.4 percent but falling short of the 5.4 percent annual growth observed in the first quarter. Ludovico Sapio, a Barclays analyst, claims that tourism significantly contributed to the expansion of Italy, France, and Spain.

In contrast, the Eurozone CPI inflation rate increased by 0.1 percent month over month in July, above expectations for a decline of -0.1 percent. This is a slower rate of growth than the 0.8 percent rise seen the month before. Above expectations of 8.6 percent, the annual inflation rate for July was 8.9 percent. The information supports anticipation for a second consecutive 50-basis-point hike in interest rates in September and is consistent with the European Central Bank’s goal of normalizing rates.

The GDP data is particularly beneficial for the Euro given the sharp rise in unfavorable sentiment toward the Eurozone and the increasing expectation of a recession as a consequence of rising gas prices. The Euro to Dollar exchange rate had increased by 0.35 percent to 1.0227 before the weekend, while the Euro to Pound exchange rate had increased by 0.5 percent to 0.8409.

The positive GDP data surprises came from Spain (+1 percent quarter over quarter), Italy (+1 percent), and France (+0.5 percent). Germany’s lack of growth was disheartening.

The good surprise in the Italian statistics, according to Paolo Pizzoli, Senior Economist for Italy and Greece, may have been caused by tourism and inventory accumulation, but he doesn’t think the third quarter’s growth rate will match the second quarter’s.

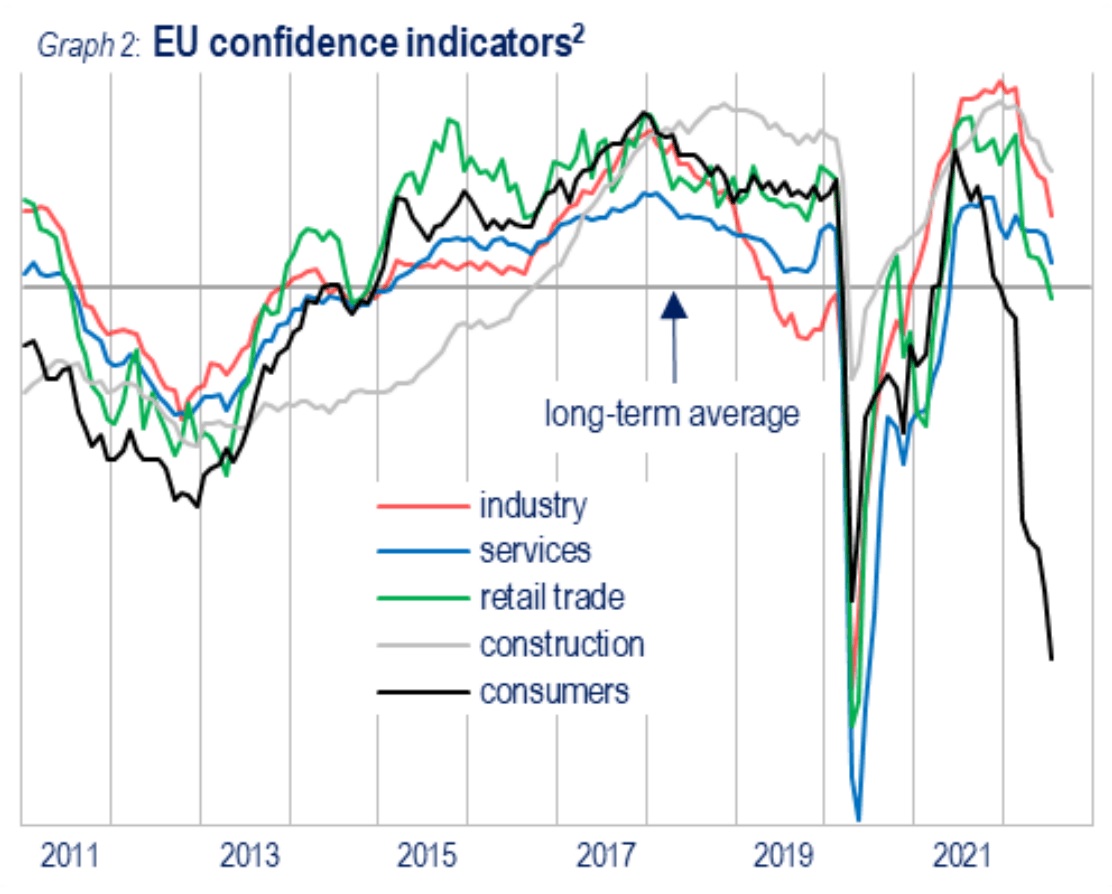

“With the exception of the construction and retail sectors, confidence indicators fell in July. The impact of inflation on disposable income will increase, and the crisis in the government may make people more cautious about their spending and investment decisions “Observes Pizzoli.

The third quarter of the Eurozone as a whole is expected to be sluggish, according to experts at Barclays. By the beginning of the new year, according to Sapio, the eurozone will be in a recession. At the start of the third quarter, there are weak signals that the recession is picking up steam.

Studies carried out in July indicate that the growing cost of living is having a detrimental effect on consumers’ financial situations and restricting their ability to make purchases. Therefore, the GDP for the second quarter gives the Euro exchange rates a break and gives traders a chance to lock in profits before the beginning of the next month.

However, it is anticipated that the main storyline harming the single currency of the Eurozone would continue to be the grim outlook and ongoing gas supply issues.