Gas Price Surge and Inflation Uptick Prompt Caution in Interest Rate Decisions

Gas Price Surge and Inflation Uptick Prompt Caution in Interest Rate Decisions

An escalation in natural gas prices and an increase in U.S. core inflation have set off signals that may nudge the Bank of England toward another interest rate hike by the end of the year.

Gas Price Surge Raises Inflation Concerns

The recent surge in gas prices coincides with a statement from the Bank of England Governor, indicating that future decisions will be approached with caution.

Simon French, an Economist at Panmure Gordon, has noted the significance of this surge in gas prices, especially in light of its impact on inflation forecasts. Gas futures have seen a sharp upward trajectory, directly influencing the November CPI forecast.

The upswing in gas prices may result in continued upward pressure on headline inflation rates, much like what occurred in August. This, in turn, could further bolster inflation expectations across the board.

Only a week ago, it appeared that gas prices might contribute to a downward movement in the 2024 Consumer Price Index (CPI), potentially offsetting the increases in oil prices. However, this balancing act has shifted, with UK wholesale gas prices surging from £89/therm last week to £140/therm.

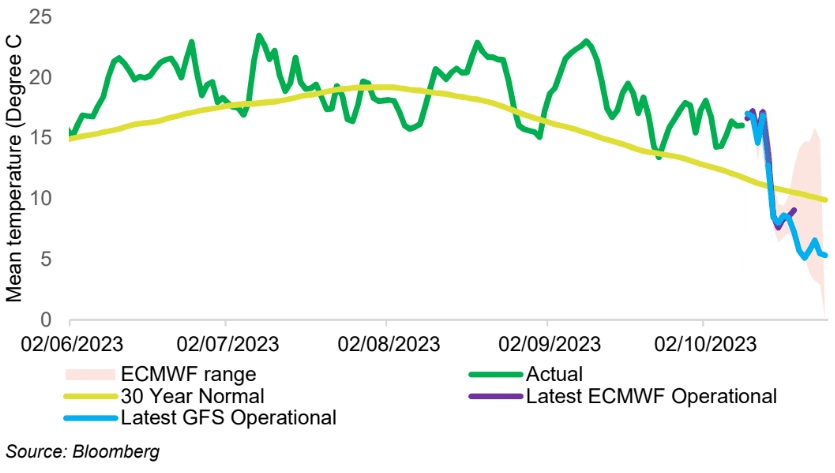

Several factors have contributed to the rise in gas prices, including a leak in the Baltic pipeline, reduced supplies from Israel, and the looming threat of strikes by workers at Australian facilities. However, economists believe that the primary driver behind this surge is the forecast for unseasonably cold weather in the latter half of October, leading to heightened demand.

U.S. Inflation’s Influence on the UK

Concurrently, the U.S. Dollar saw a significant boost after the United States reported a notable rise in core services inflation for September. The relevance of the U.S. experience lies in the observation that the UK appears to be trailing these developments.

The Bank of England’s Cautious Stance

Notably, senior rate-setters at the Bank of England have been exercising caution in signaling the potential conclusion of the rate hike cycle.

Governor Andrew Bailey addressed an IMF conference in Marrakech, emphasizing the precision required in upcoming interest rate decisions. While acknowledging the progress made in curbing inflation, Bailey indicated that challenges remain and that recent meetings have been finely balanced.

These sentiments echo the sentiments expressed by the Bank’s Chief Economist, Huw Pill, who stated earlier in the week that upcoming decisions are finely balanced. Ben Broadbent previously characterized the situation as an “open question.”

These developments have contributed to strengthening market expectations for additional rate hikes and have postponed the anticipation of rate cuts. Consequently, these dynamics lend support to the value of the Pound.

In Conclusion

The Bank of England’s caution and the recent surges in gas prices and inflation, particularly in the United States, have cast a veil of uncertainty over the future of interest rates. As the central bank navigates these factors, the economic landscape remains dynamic and subject to change. The coming months will be telling as the Bank of England continues to evaluate the situation, weighing the various influences on its monetary policy.