The Australian Dollar’s trend remains bearish for the time being, according to Morgan Stanley analysts, who are apprehensive about the “asymmetric” problems faced by the economy due to rise in infections caused by the Covid-19 Delta variant.

The Australian Dollar’s trend remains bearish for the time being, according to Morgan Stanley analysts, who are apprehensive about the “asymmetric” problems faced by the economy due to rise in infections caused by the Covid-19 Delta variant.

The financial firm also highlights in a recent study presentation that the Bank of England is among the most ‘hawkish’ central banks, which may help the Pound fare well on crosses, such as the Pound-to-Australian Dollar currency rate. “The RBA may have been somewhat more aggressive than anticipated, but we believe the AUD/USD pair’s trend stays bearish for the time being,” writes Morgan Stanley analyst David S. Adams.

Morgan Stanley has affirmed to investors that they are continuing to build short position against the Australian Dollar versus the US Dollar, noting that the market expects the Reserve Bank of Australia (RBA) to hike lending rates quicker than it will.

Foreign currencies are now maintaining a watchful eye on both the international market and the measures taken by central banks, with the general rule seeming to be that as a central bank nears a rate hike, the currency it prints appreciates.

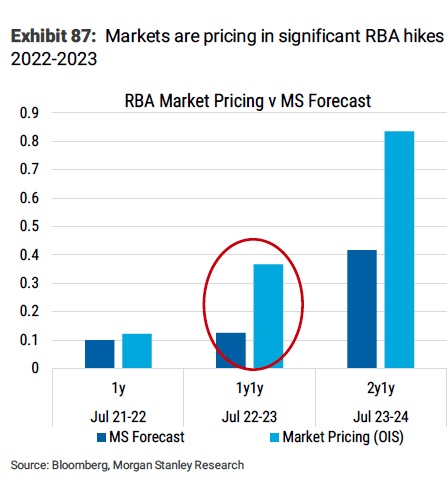

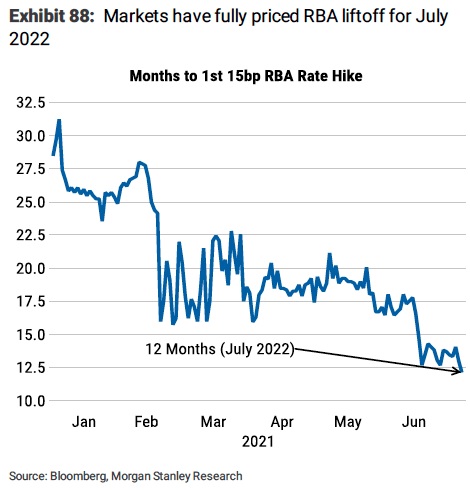

The Reserve Bank of Australia announced more cuts to its bond buying program in July, a precondition for raising the benchmark interest rates, prompting investors to boost their forecasts for when and how quickly the RBA will hike interest rate. However, Morgan Stanley’s predictions for the RBA differ from those of the market participants.

Whereas Morgan Stanley anticipates two rate hikes in 2022, market pricing indicates that investors are now anticipating the first hike in July 2022. In fact, the market expects two additional 25bp rate rises between mid-2022 and mid-2023, which is extremely ambitious.

These disparities present opportunities, especially if you believe the market is incorrect, as Morgan Stanley thinks. Morgan Stanley believes the RBA will not hurry into an interest rate rise due to concerns that Covid consequences to Australia are “asymmetrically-negative,” implying that Australia’s zero-covid policy would be more of a drag to the economy than an advantage in the future.

The viewpoint is especially pertinent in light of the ongoing Sydney lockdown, and also lockdowns in Victoria and now South Australia. When confronted with unexpected instances, authorities are quick to clamp down on activities, and because that the Delta variety is highly contagious, major interruptions are expected in the following months, something which the RBA will undoubtedly be forced to acknowledge.

“Low vaccination rates and low proportions of prior cases imply that COVID-19 has weak immunity currently, and the Delta variant’s rapid spread is alarming,” Adams adds.

“The growing effect of the Delta variant may be dampening forecasts for the global economy, specifically in regions where vaccination rates are still low and/or zones where authorities’ response mechanisms are more moderate, implying a hiatus in global economic growth,” Adams says.

In the meantime, Morgan Stanley considers the Bank of England to be “one of the G10’s hawkish central banks.” According to Morgan Stanley, “GBP might gain on crosses, against the Aussie for instance.” They note that near-term traders have cut long Pound Sterling holdings through the options market, implying that setup for a Pound comeback is getting more precise.

Morgan Stanley projects the Australian-US dollar currency pair exchange rate to trade at 0.77 by the end 2021, 0.76 by the end of next March, 0.75 at the end of June next year, and 0.78 at the end of September next year, according to Morgan Stanley.Concurrently, they expect the Pound-Dollar exchange rate to trade at 1.40, 1.41, 1.41, and 1.42.

In the aforementioned periods, this indicates a cross projection of 1.8181, 1.8552, 1.88, and 1.82 for the Pound-Australian Currency exchange rate.