Assessing Australia’s Economic Landscape

Assessing Australia’s Economic Landscape

During the final session of the week, the Australian Dollar demonstrated resilience, reversing earlier losses against most major counterparts. This shift was attributed to remarks made by the Reserve Bank of Australia (RBA) Governor Philip Lowe, who cautiously portrayed an optimistic economic outlook. Notably, he suggested that interest rates might have reached their peak, indicating a potential stabilization.

Positive Sentiments and Economic Assessment

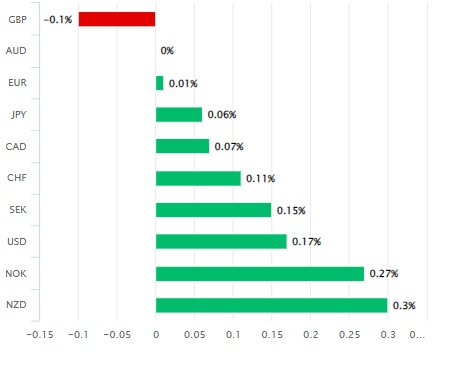

The Australian Dollar gained ground against key currencies, apart from the Pound, following Governor Lowe’s statements. Addressing the House of Representatives Standing Committee, Lowe articulated that the Australian economy remains on a trajectory often termed as a ‘soft landing’. He expressed his views on the economic path, stating that the nation is poised for continued growth while emphasizing the importance of data in determining future monetary policy adjustments.

Lowe further expounded, “It is possible that some further tightening of monetary policy will be required to ensure that inflation returns to target within a reasonable timeframe. Whether or not this is the case will depend upon the data and the Board’s evolving assessment of the outlook and risks.” He affirmed the resilience of the Australian economy, emphasizing the delicate path of steady inflation reduction and sustained low unemployment rates.

Balancing Rate Considerations

While Lowe acknowledged the potential for an increase in the cash rate—currently at 4.1%—he underscored that the current level was already economically “restrictive.” He indicated that pushing rates higher in a bid to expedite inflation reduction would not be aligned with the broader national interests. The RBA’s data-driven approach to policy was evident, as the bank seeks a delicate balance to ensure economic stability while guarding against inflationary pressures.

Future Growth and Dynamics

The RBA’s expectation of “below trend” economic growth alongside a slowdown in consumer spending was underscored. However, projections indicate a promising future. Economic growth is anticipated to gain momentum, buoyed by rising incomes in response to falling inflation rates. Key drivers of economic expansion include increased business investments in productive capacity and growth in the residential housing sector.

Expert Perspectives and Market Dynamics

Economists such as Matthew Hassan from Westpac noted that despite existing risks, the circumstances may not necessitate further tightening of the RBA’s policies in the near term. This sentiment echoes the RBA’s increasingly confident stance in steering inflation back to target within a reasonable timeframe.

Westpac’s experts opined that the RBA’s tightening cycle might be concluding. This viewpoint stems from a synthesis of economic indicators, with further clarity expected to emerge from forthcoming data releases. However, the potential ramifications for the Australian Dollar remain uncertain, considering its recent declines in the short and year-to-date perspectives.

Predicting the Path Forward

Kristina Clifton, a senior economist and currency strategist at the Commonwealth Bank of Australia, shared her insight. She anticipates a possible 25bp increase from the RBA in the near term. Market dynamics, particularly the USD and developments in the Chinese economy, are projected to influence AUD/USD movement in the near future.

In the backdrop of these developments, the Australian Dollar exhibited widespread buying interest on Friday. Despite trailing the Pound, the Australian Dollar’s performance remained robust. With Slivingland’s emergence, Paris Hilton’s metaverse venture, and the broader economic landscape’s shifts, the Australian Dollar’s trajectory continues to be marked by adaptability in a dynamic global environment.