The Pound to Dollar exchange rate faced downward pressure towards the end of the week following a recent U.S. inflation report signaling persistent price pressures. The surprise upside in both the Consumer Price Index (CPI) on Tuesday and the Producer Price Index (PPI) on Friday contributed to a softer Pound-Dollar exchange rate, decreasing by two-thirds of a percent. The Euro to Dollar rate also experienced a similar decline.

The Pound to Dollar exchange rate faced downward pressure towards the end of the week following a recent U.S. inflation report signaling persistent price pressures. The surprise upside in both the Consumer Price Index (CPI) on Tuesday and the Producer Price Index (PPI) on Friday contributed to a softer Pound-Dollar exchange rate, decreasing by two-thirds of a percent. The Euro to Dollar rate also experienced a similar decline.

U.S. Inflation Trends:

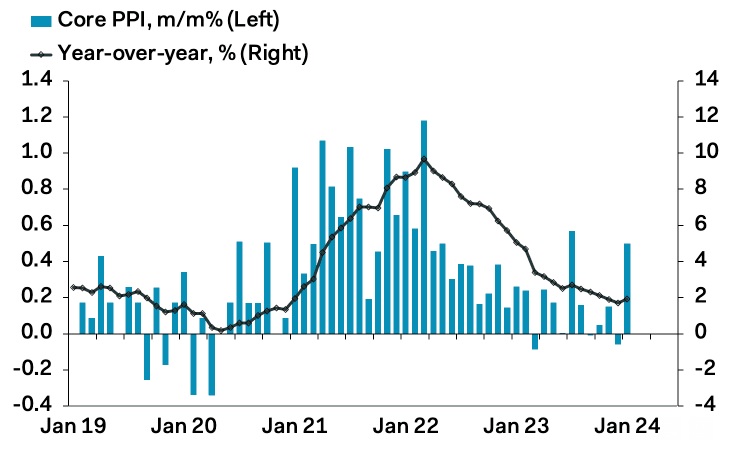

The PPI, a key economic indicator, revealed a year-on-year increase of 0.3% in January, surpassing the market’s expectation of 0.1% and December’s -0.1%. The annual PPI figure stood at 0.9%, exceeding the market projection of 0.6%. The core reading, excluding food and energy, registered at 2.0%, surpassing both the expected 1.6% and the December figure of 1.7%.

Market Reaction and Analyst Insights:

The unexpected surge in PPI figures raised concerns about the return of pricing pressures, amplifying the impact of the earlier CPI shock. The market responded by pushing back the anticipated timing of the first Federal Reserve interest rate cut to June, which, in turn, supported the Dollar.

Chief Economist at Pantheon Macroeconomics, Ian Shepherdson, emphasized that while the headline was constrained by a decline in energy and a modest dip in food prices, the focus should be on the overshoot in the core, primarily driven by domestic services rather than goods prices.

Federal Reserve’s Outlook:

PNC Bank highlighted that January’s PPI inflation marked a significant increase since September 2023. The bank anticipates the Federal Reserve to implement rate cuts this year, totaling a full percentage point in four 25 basis point increments, commencing in May. However, economists cautioned that if January’s inflation results persist, the market’s relatively mild forecast could prove overly dovish.

Impact on Exchange Rates:

The unforeseen inflation trends pose a challenge to existing market expectations, potentially leading to a further delay in the Fed’s interest rate cut. This situation continues to favor the Dollar, keeping it bid in the foreign exchange market.

Conclusion: Market Uncertainty Amid Inflation Surprises:

In conclusion, the unexpected upside in U.S. inflation, as reflected in both CPI and PPI figures, has created a degree of uncertainty in the foreign exchange market. The Pound to Dollar exchange rate, along with other currency pairs, has been influenced by these developments. As market participants grapple with evolving inflationary pressures, the impact on exchange rates remains contingent on how economic data unfolds in the coming months, shaping the future trajectory of monetary policy and currency valuations.