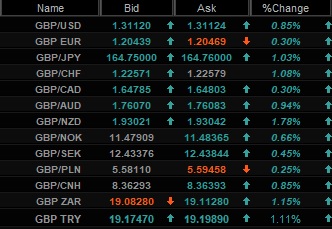

A strong mid-week rise in the pound versus the greenback and Eurodollar has erased its early April falls, and there is corroboration that this buy began in Beijing and was designed to keep the trade-weighted renminbi from appreciating further. Despite a late-night bounce on Wednesday, the pound held around its April highs versus the dollar and the euro on Thursday. This presumably mirrors an effort to halt or even reverse a rise in China’s trade-weighted renminbi.

A strong mid-week rise in the pound versus the greenback and Eurodollar has erased its early April falls, and there is corroboration that this buy began in Beijing and was designed to keep the trade-weighted renminbi from appreciating further. Despite a late-night bounce on Wednesday, the pound held around its April highs versus the dollar and the euro on Thursday. This presumably mirrors an effort to halt or even reverse a rise in China’s trade-weighted renminbi.

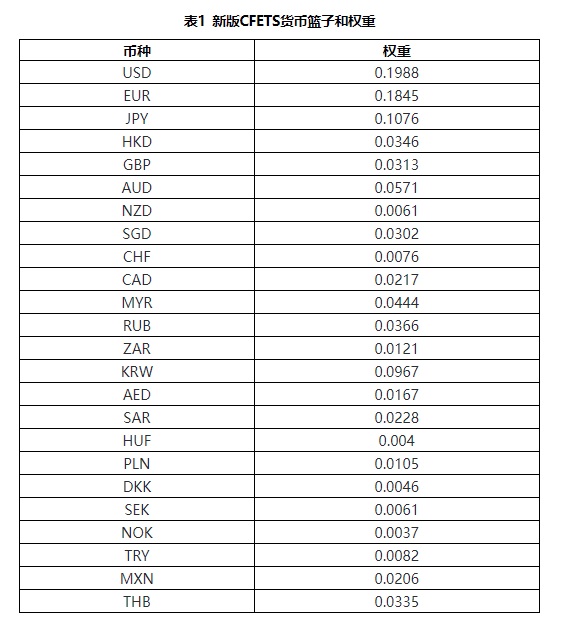

Lawmakers in Beijing have regularly called for a fall in the trade-weighted Renminbi during the currency’s nearly two-year surge, which would have wide-reaching consequences for other currencies, such as the British pound, US dollars and Japanese yen.

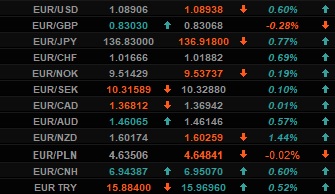

To begin with, this suggests that USD/CNH is likely to correct upward in the near future, but this might also have wide beneficial consequences for the USD/JPY and Sterling exchange rates, as well as varying consequences for the euro.

Whether the assessment is correct can be determined in part from the near consistent extremely similar intraday moves by the GBP/USD and GBP/CNH pair, as depicted in the charts throughout this report and recorded from the final hours of the London session to the early hours of last Thursday.

Analysis from the Bank of England reveals that this precise movement, known as “co-movement,” indicates that there is a shared pattern or reason pushing the Sterling exchange rate cluster where it is seen.

“In the foreign currency market, it is rare for sterling to transform into “the story,” and this is reflected in the comparative lack of substantial co-movement between sterling exchange rate pairings. Nonetheless, there have been other occasions in which sterling has taken center stage, and the MSTs have reflected this.” the document arrives at a decision in part.

According to the Bank of International Settlements’ analysis, China’s 2015 foreign currency policy initiative to control the Renminbi into a goal of stability versus trading partner currencies resulted in heightened co-movement between USD/CNH as well as other Dollar rates.

In times of “countercyclical management” similar to the current scenario, co-movements between USD/CNH and the GBP/USD and GBP/CNH pairs were found to be extremely rare, and this may be one among the reasons why it was just witnessed between GBP/USD and GBP/CNH pairs, and between EUR/USD and EUR/CNH pairs.

One possible explanation is that Dollars have indeed been liquidated, while the co-movement in Sterling, Euro, and Renminbi is concentrated in these three currencies, which suggests a currency exchange rate administration exercise aimed at reining in a nearly two-year Renminbi surge.

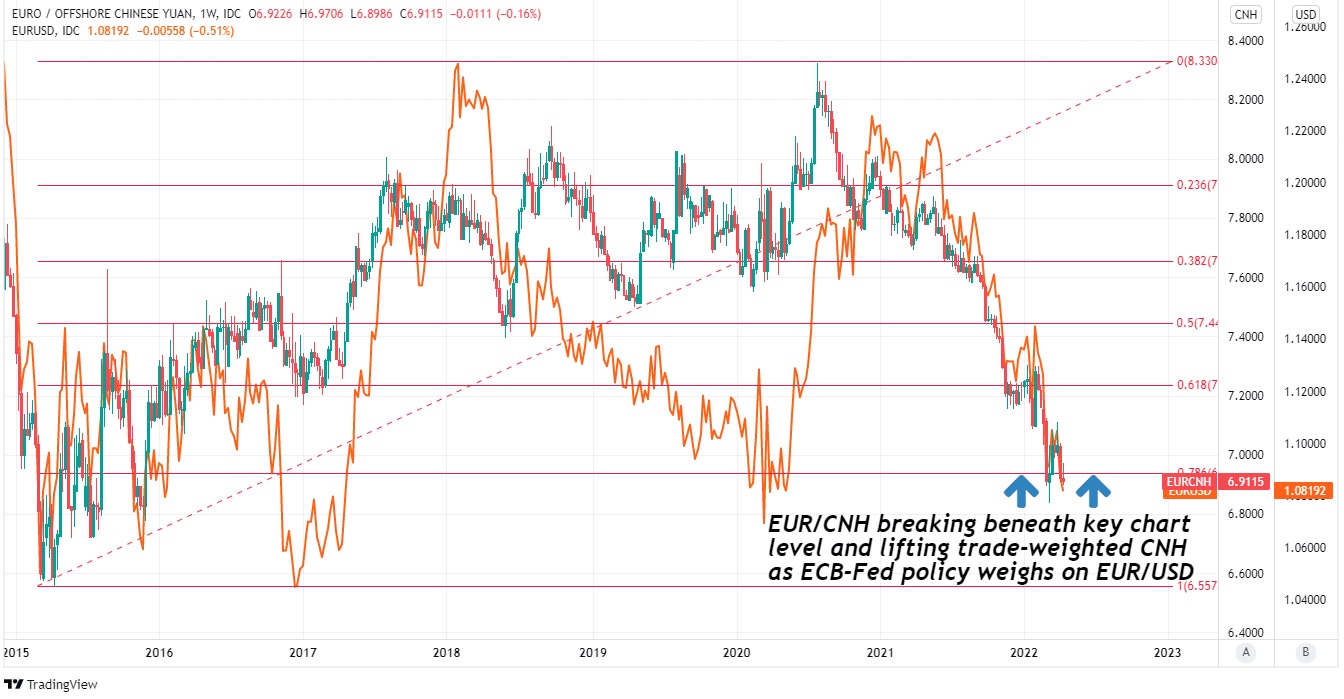

Thanks to a mixture of sharp decreases in USD/CNH and declines by rest of the currencies compared to the greenback, the Renminbi has been increasing quickly since 3Q20 in trade-weighted or aggregate measures, frequently provoking objections from the People’s Bank of China (PBoC).

Trade-weighted renminbi levels have thus far been restrained or reduced by attempts to fix the USD/CNY exchange rate, which has a considerable impact on the USD/CNH off-shore renminbi pair.

There is minimal disparity between the Euro and the Dollar in the China Foreign Exchange Trade System index when it comes to the trade-weighted Renminbi and USD/CNH. Because the euro and the Euro/USD exchange rate have dropped so much due to the hawkish Federal Reserve policy agenda and the widening gap between the forecasts for benchmark rates in Europe and the United States, any “basket control” action in Beijing may have to include this currency pair.

One way to do this is to use GBP/EUR and its 15% composition in the aggregate or trade-weighted Euro index to create a pressure nozzle effect using trade-weighted Sterling and Euro benchmarks. If you purchase the GBP/USD pair, you raise the GBP/EUR pair as well, which in turn lowers the Euro’s tendency to fall against rest of the currencies, such as the Renminbi.

In simpler terms, the PBoC may regard the purchase of GBP/USD and GBP/EUR as a limited and indirect remedy to the trade-weighted Renminbi issue. In contrast, reducing the impact on the Renminbi from the euro is expected to either limit or deflect the appreciating force on the US Dollar. As a result, the devaluation of the trade-weighted value of the renminbi might potentially have an impact on the USD/CHF, USD/CNH, and perhaps even the USD/JPY.