The British Pound went up against the Euro, the U.S. Dollar, and most of its other peers after a string of strong inflation numbers in the UK. These numbers mean that the Bank of England will raise interest rates again in May. According to the ONS, the year-over-year increase in March was 10.1%, which is a little bit less than the 10.4% increase in February. But it’s important to note that the number was higher than the 9.0% that experts had predicted. In the United Kingdom, the inflation rate has been higher than expected in every area.

The British Pound went up against the Euro, the U.S. Dollar, and most of its other peers after a string of strong inflation numbers in the UK. These numbers mean that the Bank of England will raise interest rates again in May. According to the ONS, the year-over-year increase in March was 10.1%, which is a little bit less than the 10.4% increase in February. But it’s important to note that the number was higher than the 9.0% that experts had predicted. In the United Kingdom, the inflation rate has been higher than expected in every area.

The rise was caused by a 0.8% increase from one month to the next, which was more than the 0.5% increase that was expected. The Core Consumer Price Index (CPI) inflation rate for March stayed the same as the previous month, at 6.2%. This was higher than what the market had expected, which was 6.0%. The core rate went up by 0.9% from one month to the next, which was more than the 0.6% that was expected.

Edoardo Campanella, an economist at UniCredit Bank, found that the above number was much higher than what the Bank of England had predicted in its Monetary Policy Report for February 2023. The core services CPI, which does not include travel, package trips, or education, is the best way for the Bank of England to measure inflation in the country. This measure stayed the same at 6.4% year-on-year.

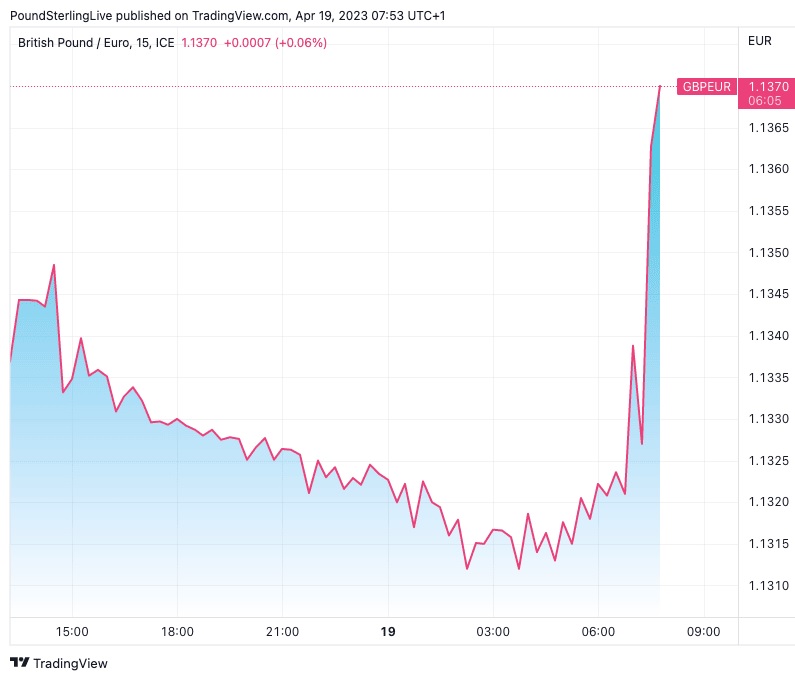

The Monetary Policy Committee of the Bank of England is likely to be disappointed with the information given, since they had expected inflation to drop more during this part of the economic cycle. Given how strong inflation is, how tight the job market is, and how much wages are going up, it seems possible that rates will go up by another 25 basis points in May. As soon as it came out, the Pound to Euro exchange rate went up to 1.1350 as buyers thought about the possibility of more hikes after May.

The exchange rate between the Pound and the Dollar went up to 1.2434 because the market thought it was less likely that the UK’s central bank would lower interest rates by the end of the year than the U.S. The March UK CPI figures show a persistently high level, according to Roberto Mialich, an FX Strategist at UniCredit Bank in Milan. Also, the movements of the USD on different markets are making the pound strong right now.

At the moment, the markets are planning for a rate hike of 25 basis points in May and a total rise of 60 basis points before a summit. This means that the rate could go up by another 25 basis points in the near future. Francesco Pesole, who is the FX Strategist at ING Bank, says that the new data makes it more likely that the Bank of England will raise rates by 25 basis points. If there isn’t evidence that inflation and wages are going down in a good way, it will be hard to convince others to keep things the same, even though we and other MPC members are skeptical about how long inflation will last.

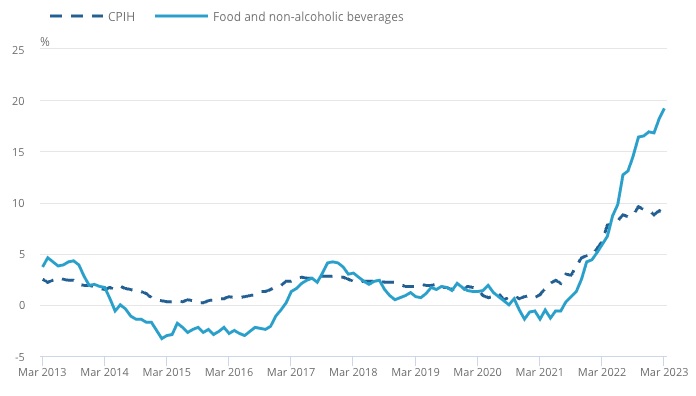

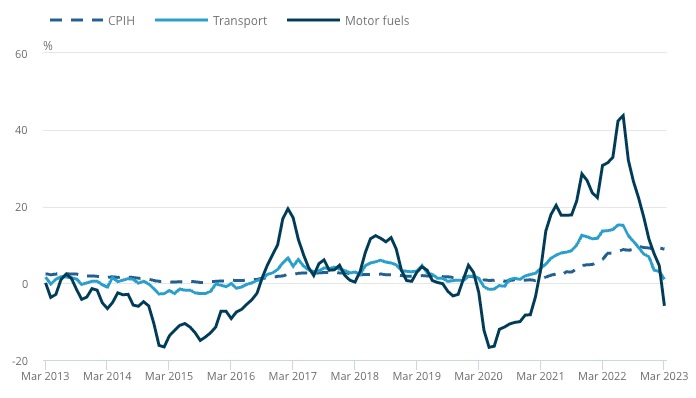

Based on bullish bets from the Bank of England, ING thinks that the GBP/EUR exchange rate may hit 1.1363 in the near future. Even though oil prices dropped sharply, inflation in the UK stayed above 10%. This is because the increase caused by Russia’s invasion of Ukraine in 2022 is no longer included in the figures. Still, the rise in product prices after the attack has had a delayed effect on other parts of the inflation package, like food, drinks, and comforts.

The year-on-year growth of food and non-alcoholic drinks was 19.2% in March, which is a lot higher than the 18.2% growth rate from the previous month. Susannah Streeter, who is in charge of money and markets at Hargreaves Lansdown, says that food prices haven’t gone up so quickly in one year since August 1977, when the Queen was celebrating her silver jubilee and a smaller one-pound note was introduced.

The Bank of England has always predicted that inflation will drop quickly after 2023. By 2024, the average rate is expected to hit or drop below the 2% goal. According to the Monetary Policy Report from February, the inflation rate was expected to reach 3% in the first quarter of 2024 and 1% in the first quarter of 2025. Peter Garnry, an analyst at Saxo Bank, says that these important data points make it hard to believe that the Bank of England’s CPI forecasts will be so highly deflationary.

Frances Haque, who is the chief economist at Santander UK, says that the increase in energy costs will cause the Consumer Price Index (CPI) to go down in the coming months. But this drop won’t have any effect on the core inflation, which is expected to stay high. Haque says that this, along with the fact that the new data on wage growth didn’t show a big slowdown, shows that the MPC has more work to do.

Derek Halpenny, who is the Head of Research for Global Markets EMEA at MUFG, says that the Bank of England has good reasons to raise interest rates by 25 basis points at its next meeting on May 11. But he says that “this possibility has already been fully taken into account by the market.” Halpenny says that the good news for the pound from this information is likely to be short-lived.

Retail sales data will be released on Friday at 7:00 a.m., and PMI data will be released at 9:30 a.m. Before the weekend, unplanned events in this situation could cause some short-term disruption.