The Bank of England (BoE) risks going overboard if it keeps raising the Bank Rate as rapidly as it has in recent months, according to its chief economist Huw Pill, who hints that he, too, may prefer a swing back to more traditional sized rises as a reaction to persisting inflation threats in the near future. Huw Pill has been among the more “hawkish” representatives of the Monetary Policy Committee in past years, and his comments on Thursday recommended that a March uptick in the Bank Rate is no longer a foregone conclusion and that a 0.25 percentage point increase could be the most that can be anticipated.

The Bank of England (BoE) risks going overboard if it keeps raising the Bank Rate as rapidly as it has in recent months, according to its chief economist Huw Pill, who hints that he, too, may prefer a swing back to more traditional sized rises as a reaction to persisting inflation threats in the near future. Huw Pill has been among the more “hawkish” representatives of the Monetary Policy Committee in past years, and his comments on Thursday recommended that a March uptick in the Bank Rate is no longer a foregone conclusion and that a 0.25 percentage point increase could be the most that can be anticipated.

Chief economist Huw Pill informed the Warwick Think Tank at Warwick University on Thursday, “Pushing ahead to raise interest rates at the rate and magnitude observed over the last year would ultimately – and possibly soon – indicate that monetary policy had been cumulatively tightened too much.” “Notwithstanding, given the current state of affairs, I underscore the MPC’s requirement to remain vigilant for indications of greater-than-anticipated resilience in price pressure. In addition, I’d like to emphasize the necessity for the Committee to keep a state of preparedness to handle any such recurrence, should it arise “he added.

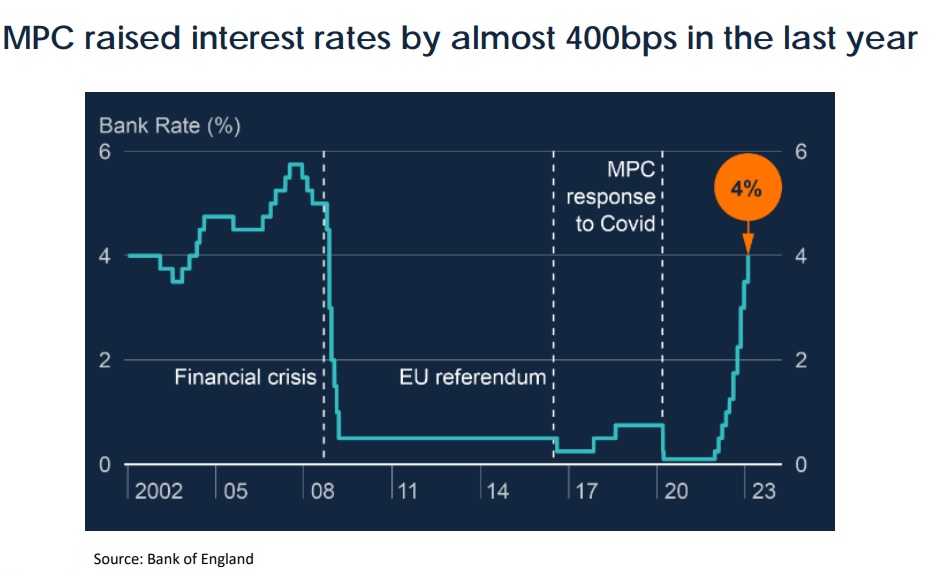

Bank Rate was raised from 3.5% to 4% earlier in the month in a fifth consecutive greater increase, following increases of similar magnitude in December, September, and August of last year, which were themselves separated by a 0.125% rise in November. This is the most significant easing of monetary policy since the late 1980s. It was the tenth consecutive rise, bringing the cumulative increase in Bank Rate since December 2021 to approximately 390 basis points.

The progression of company pricing setting, salary trends, and services prices are compatible with greater-than-desired strength in the fundamental, more enduring component of inflation, Huw Pill said Thursday. “At both the March and May MPC meetings, the Committee can reassess the consequences of inbound data for the posture of monetary policy, with the May meeting benefiting from a revised complete evaluation in the shape of MPC projections. As always, I will draw my own inferences about the Bank Rate on those instances based on my evaluation of the data .”

In accordance with BoE predictions, both UK inflation rates dropped significantly in January, with the total speed of price rise dropping from 10.5% to 10.1% and the core inflation rate falling from 6.3% to 5.7%, according to Office for National Statistics data released on Wednesday. Inflation is still well above the two percent goal, and Tuesday’s December job report contained conflicting indications regarding its future.

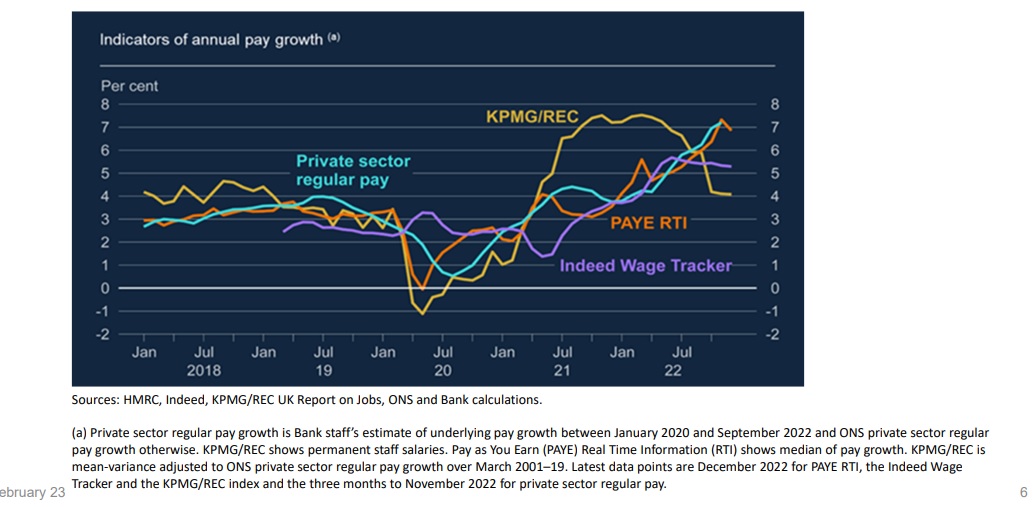

Huw Pill acknowledged on Thursday that while the ratio of job openings to unemployed individuals has recently declined to 0.9 from a peak of 1.1 in August, salary and wage growth rates have also recently accelerated to a degree that could cause inflation to become self-sustaining at above-target levels. Last quarter, total pay including incentives decreased from 6.5% to 5.9%, according to statistics released on Tuesday. However, growth in regular and permanent pay agreements hit a new record by increasing from 6.5% to 6.7%.

“Despite indicating some softening in recent months, these measures indicate the labor market remains constrained compared to past norms. This is commensurate with the ongoing resilience of salary growth in the United Kingdom “Huw Pill said on Thursday. Fixed pay growth is undoubtedly a larger worry for businesses than that resulting from arbitrary yearly incentives, and is therefore possibly a much more powerful indicator of the inflation forecast.

Increasing wage growth is frequently a consequence of rising prices of products and services, but it can also be a cause of rising prices and inflation, given the effect of rising labour costs on profit margins and price-setting choices. This dynamic is a limited and one-dimensional illustration of how inflation and its mechanical effects on national and global economies can cause it to meet the description of a “wicked issue,” which was the central topic of Thursday’s lecture at Warwick University.

“If achieving price stability is a ‘wicked issue’ in the sense described here, then it will always be imprudent to proclaim triumph, as new disruptions to price stability can always arise and spread,” Huw Pill said in part. “In the words of Thomas Jefferson, attaining real market stability requires endless caution. Among the traits of a “wicked issue” is the absence of a “stopping rule.”