In the wake of the Norges Bank’s decision to maintain interest rates and a shift in guidance, the Norwegian Krone has shown signs of softening, raising doubts about the likelihood of a December rate hike. The decision to keep interest rates unchanged was widely anticipated, and the Monetary Policy and Financial Stability Committee reached a unanimous consensus on this aspect.

In the wake of the Norges Bank’s decision to maintain interest rates and a shift in guidance, the Norwegian Krone has shown signs of softening, raising doubts about the likelihood of a December rate hike. The decision to keep interest rates unchanged was widely anticipated, and the Monetary Policy and Financial Stability Committee reached a unanimous consensus on this aspect.

However, the financial markets paid close attention to the guidance provided regarding future interest rate movements, particularly concerning the possibility of a December rate hike. This shift in guidance has now raised questions.

In September, Norges Bank’s stance was clear:

“The need for further tightening will depend on economic developments. Based on the Committee’s current assessment of the economic outlook and risk balance, it is likely that there will be an additional policy rate increase, most likely in December.”

Now, the central bank’s statement has evolved:

“Based on the Committee’s current evaluation of the outlook, it is probable that the policy rate will be raised in December. However, the Committee will receive additional information about the inflation outlook prior to its December monetary policy meeting. If the Committee gains greater confidence that underlying inflation is trending downward, it may choose to maintain the policy rate at its current level.”

The inclusion of “may choose to maintain the policy rate at its current level” introduces the possibility of a rate pause.

Kyrre Aamdal, an economist at Den norske Bank (DNB), Norway’s largest bank, notes, “Norges Bank is evidently reevaluating its December guidance due to the decline in core inflation.” He further adds, “Market expectations for the policy rate dipped slightly following this announcement. Presently, markets indicate approximately a 50% probability of a rate hike in December, down from 60% prior to the meeting.”

The recent developments have alleviated pressure on Norway’s bond yield outlook, which, in turn, has had an impact on the Norwegian Krone’s performance. The Pound to Krone exchange rate has rebounded from its earlier lows, moving from 13.5214 to 13.6050. Similarly, the Euro to Krone exchange rate has experienced an upswing from 11.78 to 11.865.

Nonetheless, despite these fluctuations, the broader weakness of the Dollar in the aftermath of the Federal Open Market Committee (FOMC) meeting has left the Dollar to Krone exchange rate still trading in the negative for the day at 11.15.

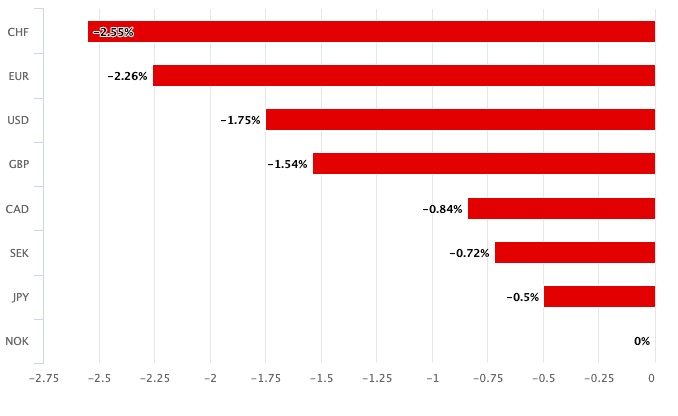

It is worth noting that the Norwegian Krone has been the weakest currency among G10 currencies over the past month, a situation that the Norges Bank finds uncomfortable.

Kyrre Aamdal from DNB suggests that the central bank might still decide to increase interest rates in December to bolster the Krone against further depreciation. He explains, “While the Krone’s weakening may not significantly impact the next few inflation figures, it could influence the central bank’s assessment of whether inflation is likely to continue on a downward trajectory.”

The Norges Bank anticipates that core inflation in October will remain in close proximity to its September forecasts, maintaining the distance from the September projections. However, the weaker Krone may prompt the Norges Bank to consider a rate hike in December.

Nonetheless, Aamdal concludes, “Overall, the threshold for a December rate hike appears to be somewhat higher than initially expected.” The central bank’s decision will undoubtedly remain under scrutiny as it navigates the complex dynamics of economic indicators and the Krone’s performance.