According to analysts at Natwest, the pound will maintain its momentum against the euro and the US dollar in the weeks ahead but the thrust is likely to evaporate in the second half of this year, giving an opportunity for the pound sellers to gain in the third-quarter of 2021.

According to analysts at Natwest, the pound will maintain its momentum against the euro and the US dollar in the weeks ahead but the thrust is likely to evaporate in the second half of this year, giving an opportunity for the pound sellers to gain in the third-quarter of 2021.

NatWest is yet another high street lending firm which has acknowledged that the UK economy will rebound sharply due to its ability to roll out vaccination program more effectively than others. The strategists at NatWest believe that the economy will rebound in a sharp manner compared with other countries.

Specifically, the analysts proclaim that the optimism about the economic rebound caused by the vaccines will be able to provide additional short-term support.

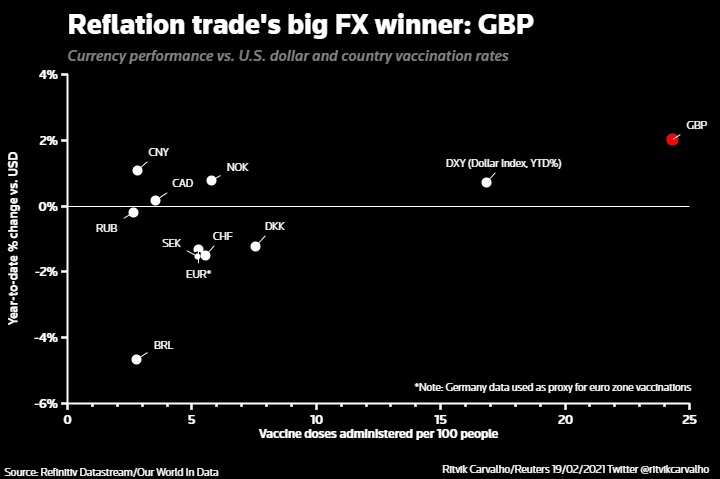

A note to clients by the Forex analysts’ team of NatWest Markets states that the pound has received support from the UK’s successful vaccination program, in comparison to other top economies.

The NatWest analysts further stated that even though the speed of vaccine roll out has been a critical aspect, the crucial factor is the UK economy’s inherent susceptibility to the vaccine. The country’s GDP was the worst affected by the outbreak of Covid-19, relative to other developed economies, and hence has the most to gain from the relaxation of prohibitions enforced to contain the spread of infection.

The comparative vaccine trade enabled the pound to eclipse other major currencies in 1Q21, specifically when compared with currencies where there is a delay in vaccination program.

The GBP/EUR exchange rate rallied to a high of 1.1800 on 2nd April, while the GBP/USD pair hit a peak of 1.4243. However, in the second-half of April, the pairs lost the gains, with loss of momentum by the pound as other developing countries narrowed the UK’s lead in vaccination program.

NatWest has pointed out that most of premium for the optimism related to vaccination program is already included in the prevailing level of the pound and so there is only minimum leeway for further gains for the pound. Nevertheless, the pound has started rallying once again this month, with analysts stating that the completion of Scottish polls has paved way for a decline in worries associated with the likelihood of yet another referendum for independence. So, the only query that remains in front of those witnessing another round of rally by the pound is that whether the uptrend will last or not in the months ahead?

The institution expects the uptrend to continue on the basis of the UK government’s plan to exit lockdown. The third crucial unlocking phase is due to arrive tomorrow i.e. May 17, 2021. Notably, the ultimately unlocking is planned for June 21 as long as the UK does not face another reversal in the form of increasing Covid-19 infections.

NatWest has also stated that further support is possible from an unlocking of household savings which has risen considerably during the Covid-19 lockdown period and ultra-loose monetary and fiscal policies.

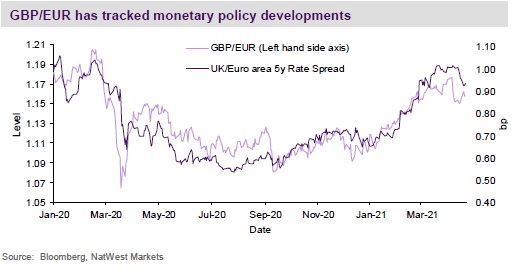

In fact, a major portion of the latest uptrend in Sterling was based on the Bank of England’s May 06 monetary policy committee meeting in which members decided to minimize the level of weekly quantitative easing program and simultaneously upwardly revised the economic forecasts. The Bank of England now expects the UK economy to bounce back to its pre-pandemic level before the end of this year.

NatWest opines that with the passage of time, there would be more evidence of the impact of Brexit on GDP growth. Sluggish productivity, rising economic problems and a declining maintainable current account deficit scenario are anticipated to affect negatively. In the meantime, improvements in the Eurozone and the US should provide some support to the relevant currencies.

The eurozone’s quickly expediting vaccination program will place the bloc in a situation to unlock and create a positive view about Eurozone assets among investors. In this regard, NatWest stated that the “May ECB has the look of the high water mark for dovish policy guidance. The June meeting should be an inflection point in policy, with updated forecast s and an update on the central bank’s asset purchase program. These can play EUR positive.”

NatWest views GBP/EUR trading in a comparatively narrow range in Q2 and Q3 2021, with risks lopsided on the higher side at the beginning before declining in the second-half.

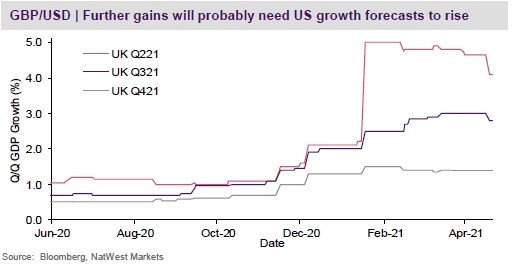

The US economy, in the meanwhile, is noted to be recording robust rates of growth led by solid domestic demand. In this regard, NatWest has opined that Capital inflows appearsto be not causing any mitigation of trade balance deficit granted high asset valuations and negligible US yields.

Concurrently, several countries should gain from rising import demand in the US. Economists at NatWest anticipate the Federal Reserve to stay decisively dovish and hold pressure against tightening anticipations from market participants. Therefore, according to NatWest, monetary policy is not anticipated to offer any significant support to the greenback in the short-term.

Nevertheless, economists have pointed out that discussion about a likely Fed taper i.e. cut down on quantitative easing can happen in the second half of 2021 and that will offer slight support for the greenback.

In the second-half of 2021, the analysts expect GBP/USD to lose the gains made in the first-half of the year. Furthermore, the currency strategists predict the GBP/USD to reach 1.41 by June end, 1.43 by the last week of September and 1.41 by the end of December 2021. They predict the GBP/EUR currency pair exchange rate to trade at 1.16 by June end, 1.15 by the end of September and 1.14 by the end of 2021.