In a forward-looking analysis, Swiss bank Julius Baer anticipates that the Japanese Yen may witness a strengthening trend over the next three months. This projection is underpinned by the belief that the Bank of Japan (BOJ) is gradually moving towards a significant shift in its policy, particularly concerning its efforts to manage Japanese bond yields.

In a forward-looking analysis, Swiss bank Julius Baer anticipates that the Japanese Yen may witness a strengthening trend over the next three months. This projection is underpinned by the belief that the Bank of Japan (BOJ) is gradually moving towards a significant shift in its policy, particularly concerning its efforts to manage Japanese bond yields.

Julius Baer’s David Alexander Meier, in his recent assessment, suggests that modifications to the BOJ’s yield curve control are likely to be on the agenda at the upcoming BOJ meeting scheduled for next Tuesday. This consideration arises in response to a recent devaluation of the Yen, a decline that has surpassed a crucial threshold.

Swiss Bank Julius Baer Foresees Yen’s Resilience

According to Meier, these proposed “tweaks” to the yield curve control represent an essential step toward stabilizing the Yen’s value. Moreover, such measures could set the stage for the Yen to strengthen within the context of his three-month target, which is notably positioned below the 150 level.

The Yen’s Outlook and the “Line in the Sand”

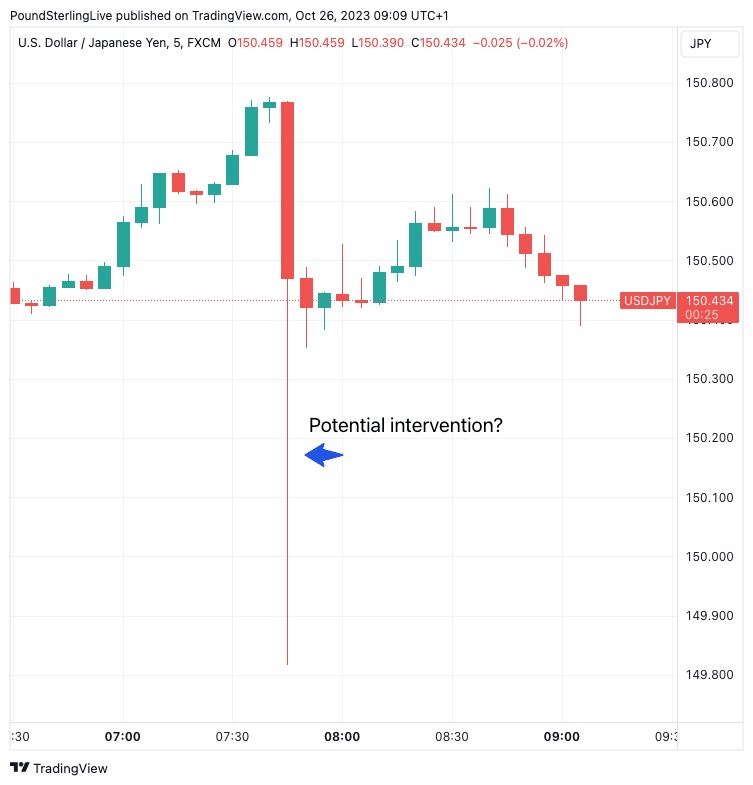

The recent depreciation of the Yen has amplified speculations surrounding its future trajectory. This speculation gained traction as the Dollar to Yen exchange rate (USDJPY) crossed the threshold of 150, a level deemed a significant boundary by Japanese authorities. These authorities have grown increasingly concerned about the Yen’s devaluation during the course of 2023.

Notably, there have been instances of sudden drops in the USDJPY rate when it breached the 150 level, including a notable occurrence on Thursday. Such events have fueled conjecture within financial circles that either the central bank or officials from the Ministry of Finance may have directly intervened in the market to safeguard the currency’s value.

The Role of the Ministry of Finance

As Meier elucidates, whether the Ministry of Finance (MoF) has initiated interventions remains uncertain, given that data on such actions are typically disclosed at the end of each month. Nevertheless, he notes that there has been no formal announcement of a “rate check,” a precursor to previous interventions, with officials merely emphasizing their vigilant monitoring of any “undesirably large moves.”

However, the prospect of sustained Yen strength hinges on the Bank of Japan’s willingness to relax its firm grip on Japanese bond yield values.

Understanding Yield Curve Control

The Yield Curve Control (YCC) program is a form of quantitative easing where the BOJ manages yields by purchasing bonds, thereby ensuring that the cost of borrowing in Japan remains affordable. A byproduct of this initiative is that Japanese yields become significantly less competitive for both domestic and international investors, contributing to currency flows that exert downward pressure on the Yen’s value.

In the view of Julius Baer, even minor adjustments to the YCC program have the potential to positively impact the Yen’s future performance. Meier outlines various possibilities, including raising the yield curve control target from 0% to 0.5% or raising the upper cap to 1.5%. Less likely but not ruled out is the scenario of the BOJ entirely abandoning YCC. The impetus for these adjustments is amplified by the fact that 10-year Japanese government bond yields have climbed to 0.87%.

BOJ’s Upcoming Policy Meeting

All eyes are on the Bank of Japan as it prepares to announce the outcomes of its forthcoming policy meeting scheduled for October 31. Meier maintains his belief that alterations to the YCC have the potential to contribute to Yen stability.

Julius Baer’s Projections

Julius Baer remains committed to its forecast, anticipating that the Dollar-Yen exchange rate will revert to 145 over a three-month period. This forecast is bolstered by the Swiss bank’s expectation that the BOJ will fully abandon the YCC policy early next year.