Amid evolving global economic dynamics, HSBC has released a noteworthy analysis indicating that the British Pound and Euro may have reached a turning point, prompting discussions about the resurgence of the US Dollar. This shift in perspective from HSBC follows a similar sentiment expressed by Barclays, another prominent British bank, which recently voiced reduced optimism regarding the Pound’s outlook.

Amid evolving global economic dynamics, HSBC has released a noteworthy analysis indicating that the British Pound and Euro may have reached a turning point, prompting discussions about the resurgence of the US Dollar. This shift in perspective from HSBC follows a similar sentiment expressed by Barclays, another prominent British bank, which recently voiced reduced optimism regarding the Pound’s outlook.

Both institutions had displayed optimism regarding the British Pound’s performance earlier this year, but according to Paul Mackel, Global Head of FX Research at HSBC, the tide is shifting. Mackel notes that while the US Dollar, often referred to as the “king dollar,” has already been making a comeback, its dominance could extend further.

HSBC had been one of the early proponents of a positive outlook for the British Pound back in late 2022, a viewpoint that emerged in the wake of market disruptions triggered by the short-lived premiership of Liz Truss.

Following HSBC’s initial endorsement, the Pound Sterling enjoyed a period of appreciation against both the Euro and Dollar, sustaining this momentum through early August 2023.

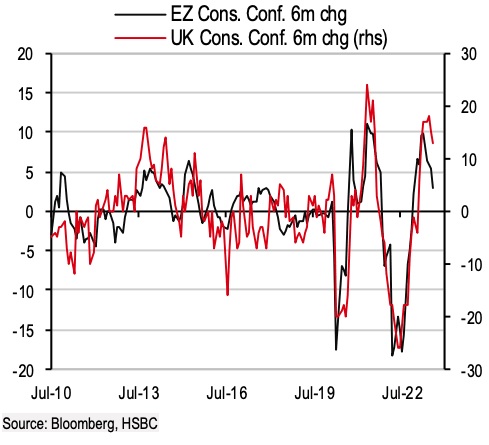

Mackel, in a research note published in early September, expressed the bank’s revised stance: “We have been upbeat on EUR and GBP since November 2022 but think the rally in each currency has played out and look for a reversion lower in the months ahead.” HSBC’s rationale for this shift in perspective points to declining consumer confidence in both the UK and Eurozone, often a precursor to macroeconomic underperformance.

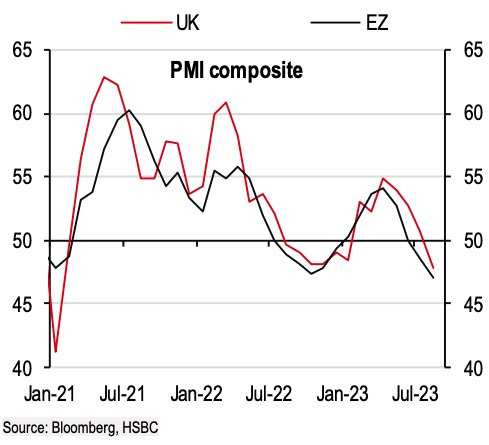

Mackel elaborates that given the prevailing circumstances, it is challenging to envision significant cyclical upside for these currencies. Additionally, HSBC analysts observe a marked deterioration in business sentiment, particularly in the Eurozone and the UK, with the once-resilient service sector now showing signs of faltering. Mackel concludes that there is little cause for optimism regarding an imminent rebound.

In the context of the UK, HSBC’s analysis highlights stagnation in housing activity, where new mortgage approvals have plateaued at levels reminiscent of the post-financial crisis era. House prices are also declining at their most rapid pace since that time.

Conversely, the US Dollar is anticipated to exhibit strength, primarily driven by resilient US economic data, revitalizing the ‘U.S. exceptionalism’ trade. Even a potential waning of the ‘U.S. exceptionalism’ narrative may not necessarily undermine the Dollar’s strength when considering its broader implications on the global growth outlook. Furthermore, while US yields are likely to decrease, other regions might discount additional rate cuts to a greater extent.

Given these factors, HSBC envisions a multi-month period of US Dollar dominance. The bank forecasts a decline in the Euro to Dollar exchange rate to 1.02 by the middle of 2024 and a fall in the Pound Dollar exchange rate to 1.18 during the same period.

Mackel emphasizes that this forecast profile suggests that the Euro to Pound exchange rate (EUR-GBP) is expected to remain relatively stable. Both economies are grappling with weakening domestic narratives that do not justify a breakout from the levels observed over the past year. Barclays, in a parallel assessment, also indicates reduced optimism about the British Pound’s prospects, particularly concerning its performance against the Euro, Dollar, and Swiss Franc. According to Themistoklis Fiotakis, an analyst at Barclays, consumer demand appears to be fading, and the labor market may finally be cooling.

Although wage growth and inflation are providing some carry support, Barclays suggests that there is limited room for further outperformance compared to the Euro or the Dollar. However, the bank’s forecasts do not anticipate a substantial collapse in the Pound’s value. Barclays projects the Euro to Pound Sterling exchange rate at 0.86 by the end of 2023, increasing to 0.87 by the end of the first quarter of 2024, with expectations of this level being sustained through the end of the third quarter of 2024. This translates into a relatively stable Pound to Euro exchange rate profile.

For the Pound to Dollar exchange rate, Barclays anticipates a profile of 1.26, 1.24, 1.25, and 1.26 for the end of 2023, the end of the first quarter, the end of the second quarter, and the end of the third quarter of 2024, respectively, indicating a measured trajectory.