The Pound to Canadian Dollar exchange rate reached a new 6-month high at 1.7314, following a Canadian jobs report that surpassed expectations. Despite the upbeat data, the Canadian Dollar finds itself among the day’s second-biggest G10 losers, reflecting its role as a ‘mini USD’ and the broader impact of the U.S. economic narrative.

The Pound to Canadian Dollar exchange rate reached a new 6-month high at 1.7314, following a Canadian jobs report that surpassed expectations. Despite the upbeat data, the Canadian Dollar finds itself among the day’s second-biggest G10 losers, reflecting its role as a ‘mini USD’ and the broader impact of the U.S. economic narrative.

Positive Canadian Job Report Fails to Boost Currency

Statistics Canada’s revelation of a 41,000 increase in employment for February, exceeding both the market’s anticipation of 20,000 and January’s 37,300, failed to bolster the Canadian Dollar. The slight uptick in the unemployment rate from 5.7% to 5.8%, in line with expectations, did not deter the market’s sentiment either. Economist Andrew Grantham from CIBC Capital Markets commented, “The Bank of Canada appeared in no rush to start cutting interest rates earlier in this week, and today’s data will do little to speed the process up.”

Canadian Dollar’s ‘Mini USD’ Status Plays a Role

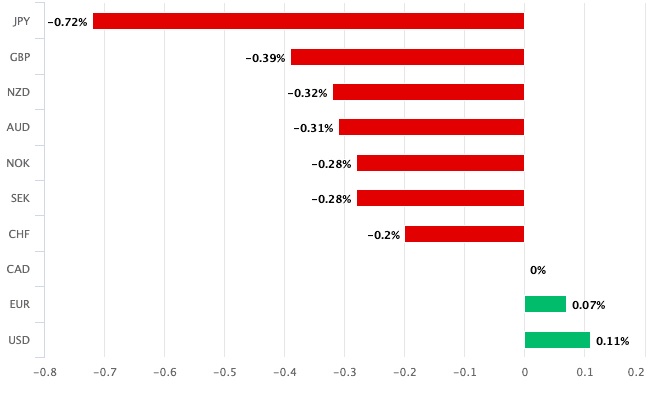

Despite the positive job report, the Canadian Dollar’s performance is intricately tied to its ‘mini USD’ status. The currency has functioned as a proxy for the U.S. dollar, and the ongoing U.S. non-farm payroll report is impacting its value. The U.S. reported a robust payroll figure but a significant slowdown in wages, indicating a potential shift in the job market that might prompt the Federal Reserve to cut interest rates in June. This expectation has spilled over to the Bank of Canada, given the deep economic and financial links between the U.S. and Canada.

Impact of U.S. Economic Narrative on CAD

The substantial increase in the Pound-Canadian Dollar, replicated across other CAD crosses, is primarily a reflection of the U.S. economic story rather than a purely Canadian one. The U.S. dollar’s decline in the wake of the non-farm payroll report is influencing the Canadian Dollar’s performance, highlighting the interconnectedness of the two economies.

Gradual Labor Market Changes and Future Rate Cuts

Despite the overall positive job report, economist Andrew Grantham notes that the hiring surge came in the form of full-time positions (+71,000) at the expense of part-time jobs (-30,000). Grantham acknowledges evidence of gradual loosening in labor market conditions but does not see an imminent need for interest rate reductions. He maintains a forecast for a potential rate cut at the June meeting. However, concerns linger over weakness in paid private sector employment and a deceleration in wage growth for permanent employees, hinting at a slow but consistent movement towards potential rate cuts by the Bank of Canada.

In summary, the Canadian Dollar’s performance, despite strong domestic job market data, is significantly influenced by its ‘mini USD’ role and the broader economic narrative in the United States. The positive employment figures, while notable, are not sufficient to detach the Canadian Dollar from the sway of U.S. economic developments, indicating a complex relationship between the two currencies.