According to an expert at one of Australia’s biggest banks, the Aussie will stay restricted for “some time ahead,” owing to a sluggish vaccination rollout. In a study paper presented, Richard Franulovich, Head of FX Strategy at Westpac, states that only a few countries highlight the dangers of a delayed vaccine roll out as the Delta variant keeps spreading more tangibly than Australia.

According to an expert at one of Australia’s biggest banks, the Aussie will stay restricted for “some time ahead,” owing to a sluggish vaccination rollout. In a study paper presented, Richard Franulovich, Head of FX Strategy at Westpac, states that only a few countries highlight the dangers of a delayed vaccine roll out as the Delta variant keeps spreading more tangibly than Australia.

“While the RBA may be boasting about a fast recovery in Australia’s gdp as soon as the coronavirus is controlled,” writes Franulovich, “the Aussie seems to have been penalized for Australia’s delayed vaccine rollout, a scenario that will not change rapidly.”

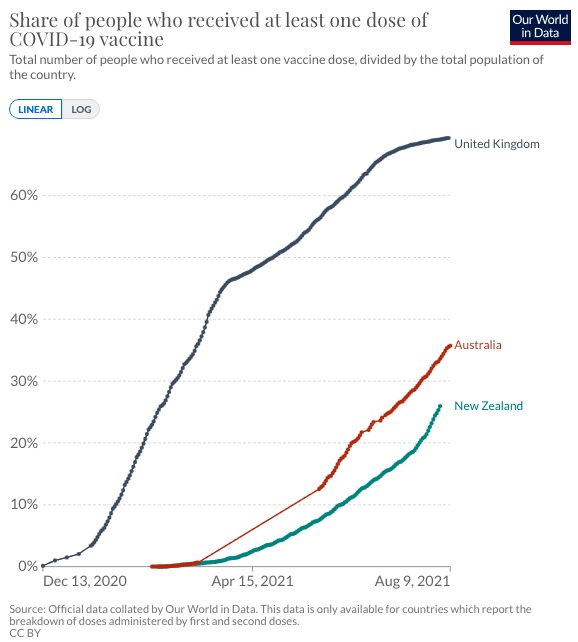

With just 36% of the population having gotten a single jab ofCovid vaccine, there is still a large disparity to bridge before the government can leave a stop-start lockdown strategy intended at eradicating Covid-19 from the society.

Until then, billions of Australian dollars are expected to be lost due to lockdowns, dampening worldwide investor interest in Australian assets.

Melbourne, Australia’s second-largest city, will remain under lock down for a second week after registering 20 fresh Covid-19 infections; the city had been scheduled to come out of its sixth lockdown on Thursday. New South Wales reported on Wednesday that it had registered 344 fresh infections of Covid-19, with officials stating that a minimum of 65 individuals in the community were contagious.

The lockdown in New South Wales is set to last until at least the end of this month, although officials will want to witness infections drop in the following days if this goal is to be met by the end of August. In the meantime, the Aussies has been one of the G10 currency underperformers, falling versus the bulk of its rivals in July, with experts blaming a downturn in Chinese economic activities and the local Covid issue.

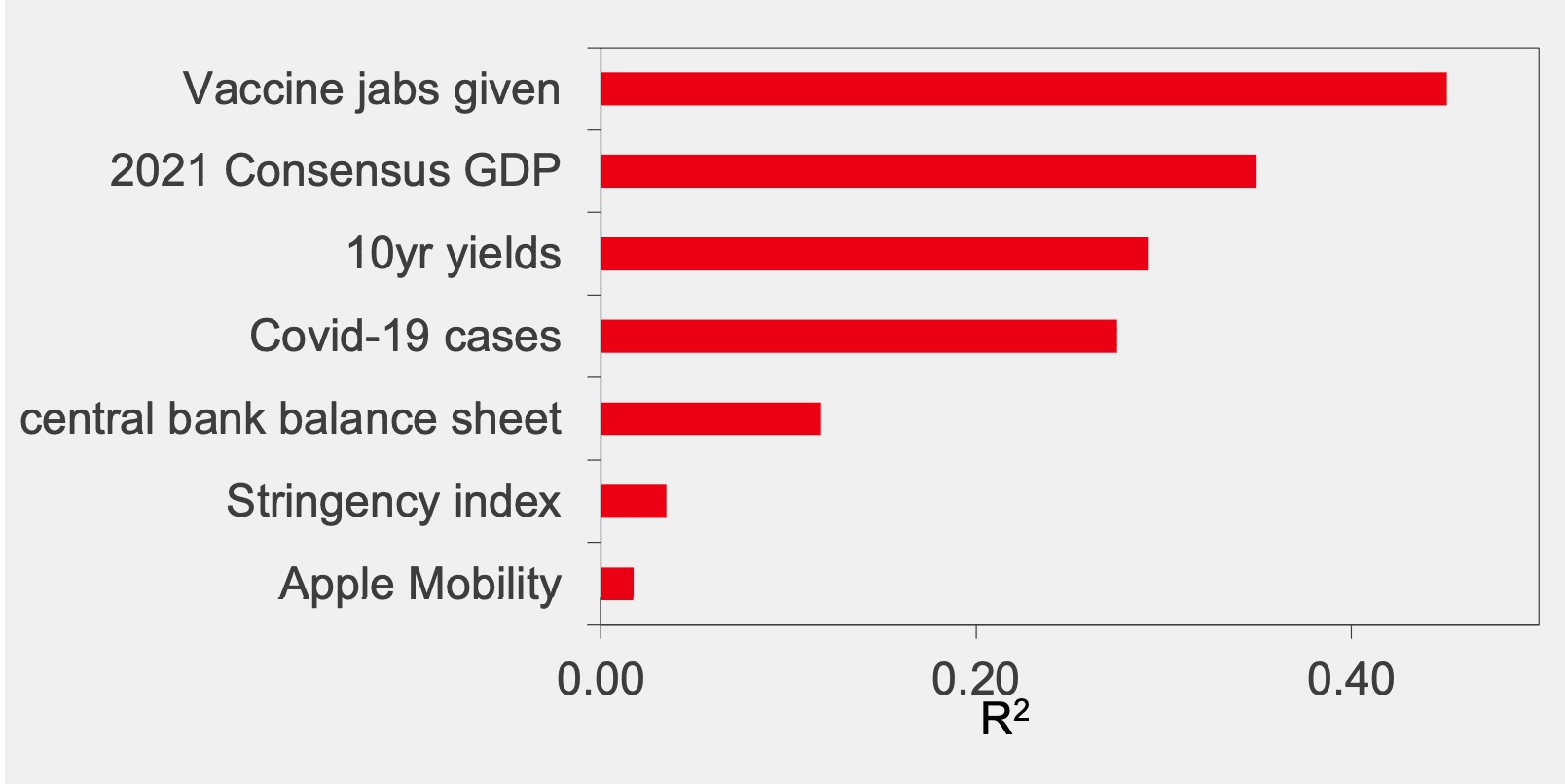

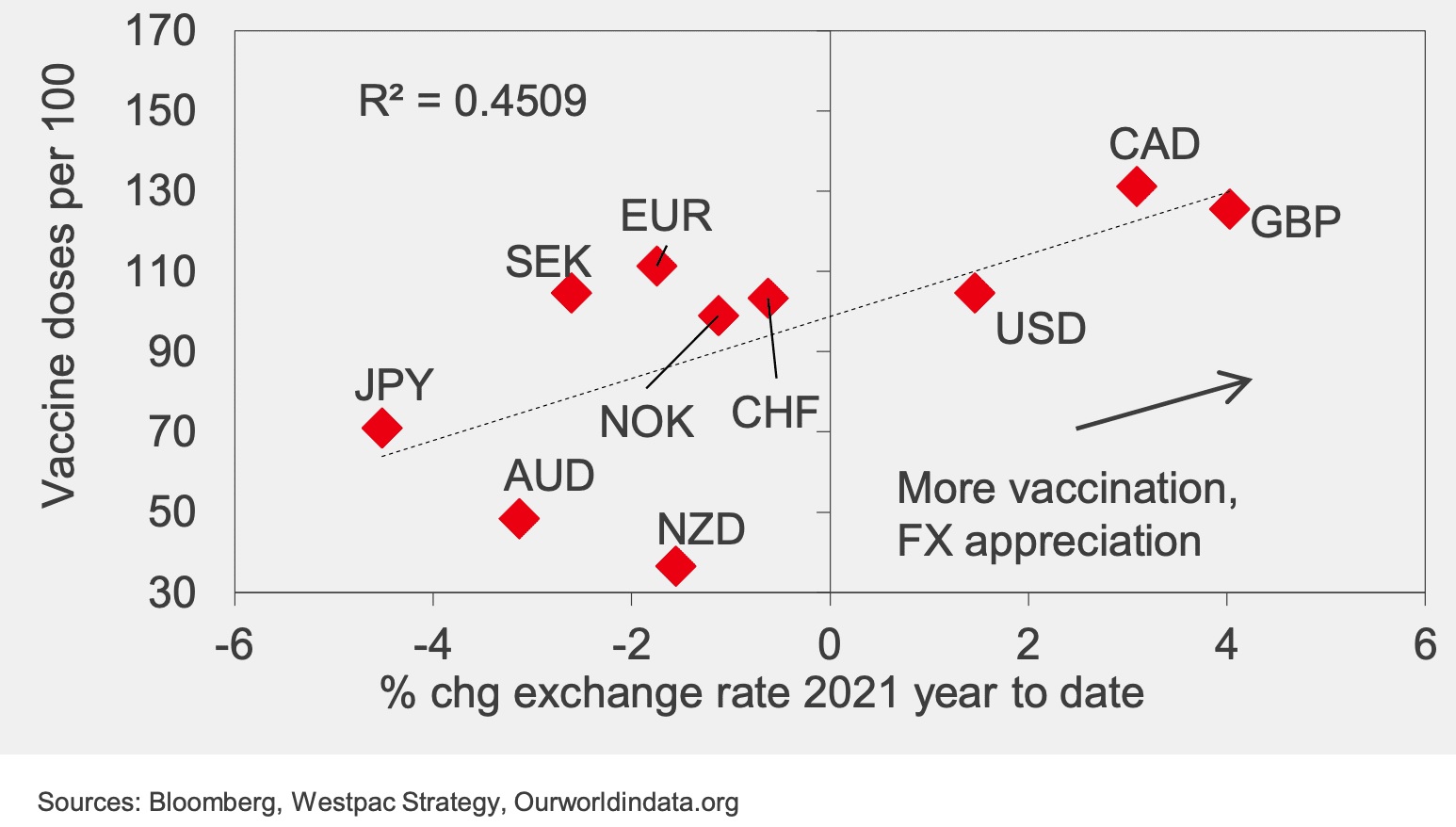

According to Westpac’s study of vaccination rates against currency performance, the top performing currencies in recent times have been those linked with rapid vaccine rollouts. “As a rule of thumb, currencies have strengthened in countries where yields and growth forecasts have increased the highest, vaccination rates were also higher, and central banks have reduced balance-sheet assistance, and vice versa.” That is not totally unexpected. Then again, vaccination rates, economic forecasts, yields, and central bank policy patterns have all been reflecting one other this year.

“Handful of economies highlight the dangers of a delayed vaccination rollout as the Delta variant infections kept increasing more visibly than Australia. There is optimism that a more vigorous vaccination deployment in the months ahead would shatter the economy’s stop-go cycle, but in the meantime, the AUD is likely to stay restricted for some time” explains Franulovich.

According to Westpac’s analysis, vaccination rates are by far the most dependable indicator for G10 currency gain in 2021. “Vaccination profiles indicate more about the durability of future recovery prospects and the space for policy support removal than any other component in our dataset,” says Franulovich. “It comes to logic that vaccination patterns have been a stronger indicator for currencies.”

“GBP, USD, and CAD outperformance this year almost exactly fits their better vaccine rollout patterns, whereas AUD and JPY underperformance follows their sluggish vaccine rollout statuses,” adds Franulovich.

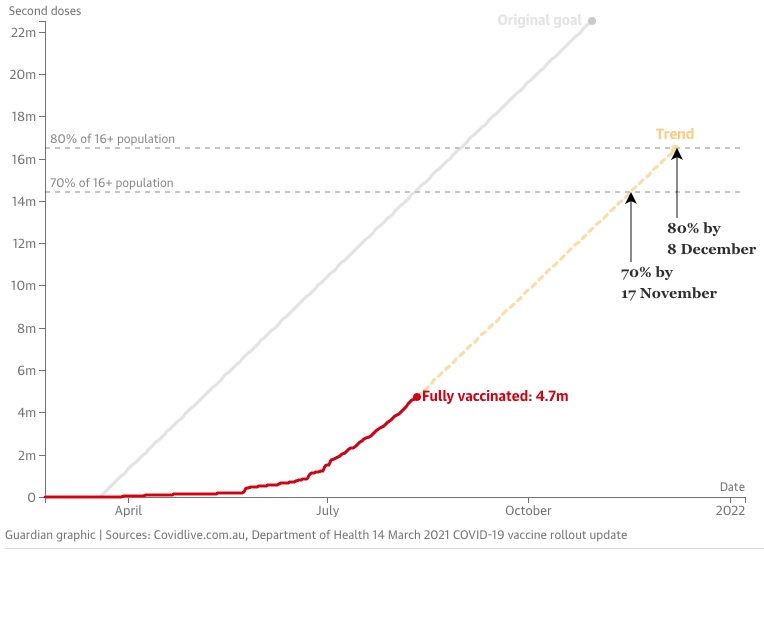

Australia’s National Cabinet stays dedicated to achieving “near-zero community infections,” but they think that in order to ultimately stop the sequence of lockdowns, complete vaccination status needs be achieved by roughly 70% of people (or 56% of the overall population).

“Nevertheless, although vaccinations have lately increased significantly (to 200k/day), owing to supply limitations, the’magic figure’ for re-opening cannot be achieved until Oct-21,” writes George Tharenou, Economist at UBS. UBS expects Australia’s third-quarter national GDP to fall by approximately 2.5% q-o-q, if Sydney is locked down for the whole 3Q21 and some other cities experience flash lockdowns.

They assess that the economic cost of NSW’s lockdown is in higher of A$1 billion each week, with an aggregate national GDP impact of approximately A$25 billion. UBS sees a significant risk that the RBA’s July economic projections are underperformed, and if lockdowns are prolonged, there is a chance that tapering will be delayed at their September meeting.

Aside from the local Covid-19 epidemic, the Aussie is believed to be one of the highly susceptible of the world’s key currencies to a Covid-led downturn in Chinese economic development. A slowing in China’s economic growth is one of many worries on investors’ radars as we enter 3Q21, given that authorities have begun putting new limits on travel in a host of economically important areas as a result of the rising Delta variant infections. “Without a question, Australia and New Zealand will be the G10 nations most affected if China’s development slows. These two are highly reliant on China for export s” Marshall Gittler, Head of Investment Research at BDSwiss Holding Ltd., agrees.

In June, Australia recorded a historic trade surplus with China, led by increased iron ore export revenue, underlining China’s importance to Australia’s foreign currency profits. As per May’s official trade statistics, China represented for 39% of Australia’s aggregate exports of A$42.23 billion ($32.77 billion), much exceeding Australia’s second-largest trading ally Japan, which accounted for nearly 10%.

Despite the fact that Covid-19 is posing a significant roadblock to Australia’s trading activities and Australian Dollar gains, Westpac’s analysis indicates that an all-out dumping of the currency is improbable. Westpac does not believe that the Chinese deceleration triggered by the Delta outbreak will be severe enough to reduce demand for Australia’s raw material exports.

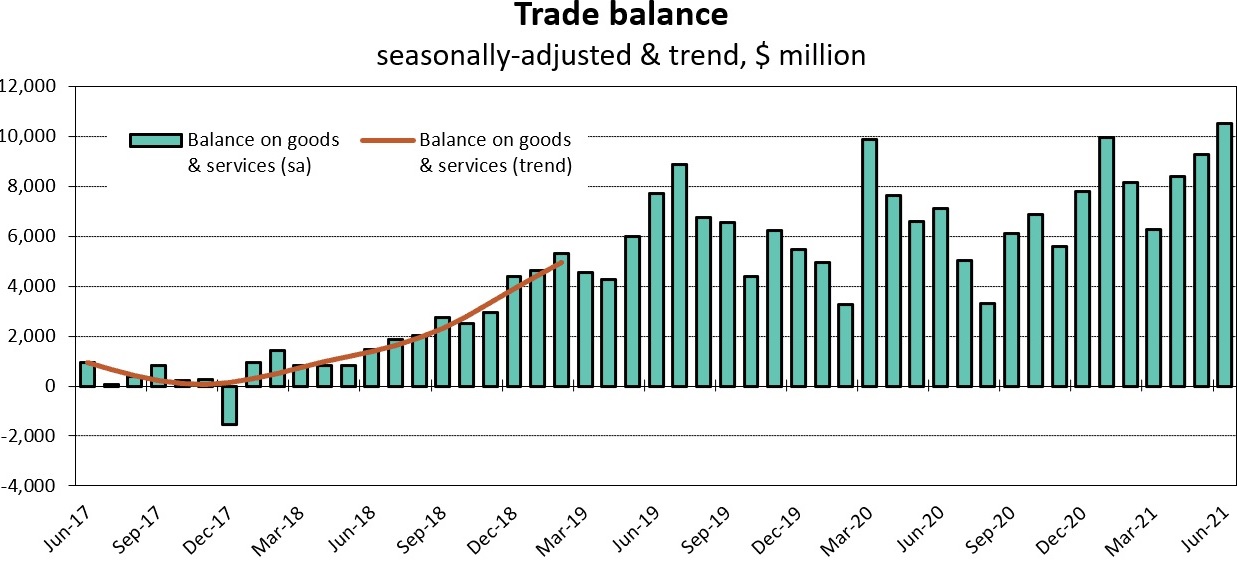

Australia’s streak of favourable trade surpluses currently runs at 42 months, with a historical level of A$10 million in June. This solid basic position is due to the export momentum – mainly in raw commodities – that has maintained despite the trade war between the United States and China, as well as the Covid epidemic.

According to Sean Callow, Senior Currency Strategist at Westpac in Sydney, the effect of the trade surplus on the Australian Dollar could become more powerful in late August and September as mining firm dividend repatriation takes shape.

“Before that anyway, it’s difficult to be excited about the Aussie,” Callow adds. “The ray of optimism on Covid-19 infection containment is much more of a Q4 possibility than a Q3 opportunity,” Callow adds.