In a surprising turn of events, the Canadian Dollar (CAD) exhibited remarkable strength against major global currencies, including the US Dollar (USD), British Pound (GBP), and Euro (EUR), following Canada’s release of an impressive labor market report for September. Statistics Canada disclosed that a staggering 63.8K jobs were added to the workforce, surpassing market expectations, which had anticipated a mere 20K job increase. Nevertheless, financial analysts caution that certain aspects of the report bear weaknesses that may temper the CAD’s upward trajectory.

In a surprising turn of events, the Canadian Dollar (CAD) exhibited remarkable strength against major global currencies, including the US Dollar (USD), British Pound (GBP), and Euro (EUR), following Canada’s release of an impressive labor market report for September. Statistics Canada disclosed that a staggering 63.8K jobs were added to the workforce, surpassing market expectations, which had anticipated a mere 20K job increase. Nevertheless, financial analysts caution that certain aspects of the report bear weaknesses that may temper the CAD’s upward trajectory.

The substantial job gain initially fueled optimism regarding Canada’s interest rates, fostering the belief that they would remain at elevated levels for an extended period, thus boosting the Canadian Dollar’s performance.

Additionally, the CAD received a significant boost from its positive correlation with the US Dollar, which surged after a robust US employment report was unveiled.

Mixed Outcomes Impact Currency Exchange Rates

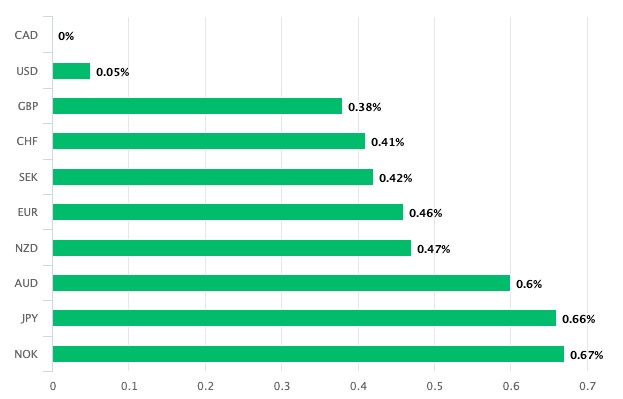

Consequently, the Pound to Canadian Dollar exchange rate experienced a 0.33% decline, settling at 1.6656, undermining the pair’s short-term recovery. Against the US Dollar, the Canadian Dollar appreciated by 0.13%, with the exchange rate reaching 1.3686. The Euro also faced headwinds against the CAD, as the Canadian unit gained 0.44%, resulting in the EUR/CAD exchange rate of 1.4396.

Economist Cautions About Weaknesses

According to Andrew Grantham, an economist at CIBC Bank, “Wage growth remained stronger than policymakers would like to see, ticking up slightly to 5.3% relative to consensus forecasts for a 5.1% rate.” Despite the promising headlines, Grantham identified weaknesses within the data that could temper both the Bank of Canada’s stance and the market’s enthusiasm for a CAD rally.

Grantham further elaborated, stating, “The increase in jobs was not exactly broad-based, and instead largely driven by a 66K gain in education which can be volatile at this time of year.” While there were increases in sectors such as transportation and warehousing, they were largely offset by declines in areas like finance, real estate, and leasing.

Moreover, Grantham highlighted that the employment growth for September leaned more towards part-time positions than full-time ones. Additionally, he pointed out that the 5.3% wage increase still reflects the previous tightness in the labor market, coupled with adjustments following last year’s surge in inflation.

Future Considerations and Potential Challenges

Grantham also provided insights into the future, stating, “With the unemployment rate off last year’s lows and job vacancies continuing to fall, wage inflation could ease fairly quickly next year.” These factors imply potential challenges for sustaining the current level of wage growth and economic momentum.

In conclusion, the Canadian Dollar’s recent surge against major currencies can be attributed to a remarkable labor market performance in September. However, financial analysts remain cautious due to certain weaknesses in the data, especially regarding job distribution across sectors and the composition of part-time versus full-time positions. Additionally, the potential for wage inflation to ease in the coming year raises questions about the sustainability of current economic momentum. These factors underscore the need for a balanced perspective on the Canadian economy’s future trajectory.